News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Fold CEO asserts DeFi will survive centralized control attempts, emphasizing its open-access and user-sovereignty principles. - Regulatory scrutiny and cyber threats like credential theft and zero-day exploits highlight security challenges in DeFi. - Institutional interest and AI-driven security tools signal evolving infrastructure to mitigate risks and enhance resilience. - Short-term consolidation is expected as projects adapt to regulations, while decentralization resists unilateral control.

- Dogecoin (DOGE) trades at $0.2176 with a $32.51B market cap, requiring a $1.48T valuation to reach $10 per token. - Technical analysts identify $0.238 as a critical resistance level, while whale activity and macroeconomic factors like Fed policy pose market risks. - Fundamental challenges include unlimited supply, limited utility beyond meme status, and competition from newer meme coins like Shiba Inu. - Analysts agree DOGE's $10 target requires unrealistic conditions: sustained bull markets, institution

- Global crypto regulations create fragmented barriers and opportunities for U.S. investors navigating cross-border compliance. - EU’s MiCA rules (2024) force U.S. firms to establish EU subsidiaries or local partnerships to access a $150B market. - U.S. investors pivot to Brazil’s $2.3B crypto framework and UAE stablecoins while adapting to Japan’s FSA and SEC’s Project Crypto. - Projected $150.1B global crypto market growth by 2029 rewards investors balancing compliance with agile strategies in emerging m

- Q3 2025 crypto market faces structural shift as Altcoin Season Index nears 40, signaling early capital rotation from Bitcoin to altcoins driven by institutional adoption and regulatory clarity. - Ethereum (ETH) leads with robust on-chain metrics, post-Dencun upgrades, and SEC reclassification, attracting $27.6B in ETF inflows and rising ETH/BTC ratio to 0.71. - Solana (SOL) and Cronos (CRO) gain traction via institutional backing, with CRO surging 42% post-Trump partnership and projected to reach $0.33 b

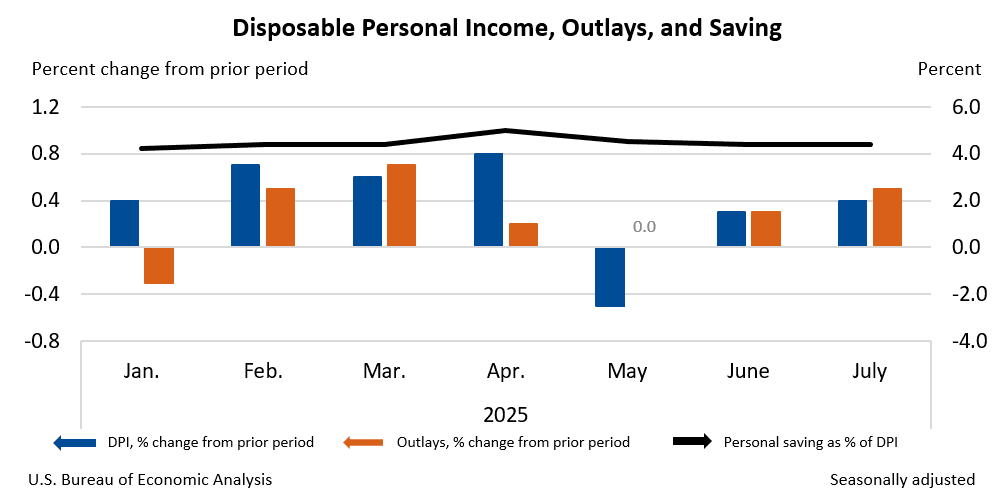

Despite high inflation, traders are betting that the Federal Reserve will cut interest rates in September, and Solana is at a critical level.

- Pump.fun's $60M buyback program redirects 100% of daily revenue to repurchase $PUMP tokens, reducing 4.2% of circulating supply. - $PUMP price surged 30% in August to $0.0040, with market cap exceeding $1.29B amid increased trading volume and Solana ecosystem dominance. - Platform's 62% revenue share in Solana memecoins and $734M annual fees fuel buybacks, boosting tokens like $TROLL by 250%. - Concerns persist over 50% early supply concentration and crypto market volatility, as Bitcoin/Ethereum fell 6-7

- Bitcoin Cash (BCH) tests $531 support as price drops 3.60% to $535.20 amid bearish momentum. - SEC-approved crypto ETFs initially boosted BCH to $585.30, but broader market corrections now dominate. - Technical indicators show mixed signals: RSI near oversold (42.89), bearish MACD (-2.31), and proximity to Bollinger Band lows. - Key support at $531.10 could trigger further declines to $481.90 if broken, while $574.20 resistance remains critical for bullish reversal. - Traders debate strategies amid high

- Japan's Gumi invests ¥2.5B in XRP to expand blockchain finance infrastructure, focusing on cross-border payments and liquidity networks. - The move follows a prior ¥1B Bitcoin purchase, combining value preservation with XRP's utility in financial services. - Partnering with SBI Holdings, Gumi aims to leverage Ripple's ecosystem and distribute RLUSD stablecoin in Japan by 2026. - The strategic investment aligns with a growing trend of public companies utilizing digital assets for yield and operational exp

- Alex Shapiro, Elon Musk’s attorney, is rumored to lead a $200M Dogecoin Digital Asset Pool (DAT), potentially institutionalizing the meme coin. - If confirmed, the DAT could stabilize DOGE’s price by creating demand floors, though its infinite supply challenges Bitcoin-like scarcity. - Technical indicators show mixed signals, with key support at $0.21 and potential breakout targets above $0.25, amid institutional accumulation and retail selling. - Pending DOGE ETF applications and regulatory clarity in 2

- EU fines Google €2.42B for search dominance abuse, marking a strategic shift from punitive fines to systemic digital market reforms via the Digital Markets Act (DMA). - DMA imposes ongoing compliance costs on "gatekeepers" like Google and Apple, with cumulative expenses projected to exceed €10B by 2026, challenging profit margins and innovation investment. - Regulatory shifts create opportunities for smaller rivals (e.g., DuckDuckGo) while triggering geopolitical tensions, as U.S. officials criticize EU

- 06:47DOGE treasury company CleanCore has accumulated purchases of over 500 million DOGEChainCatcher reported that CleanCore Solutions, Inc. (ZONE) announced today that the official DOGE treasury, managed by the newly established entity House of Doge and endorsed by its Dogecoin Foundation, has accumulated over 500 million Dogecoin (DOGE). This milestone marks that more than half of the initial goal of acquiring 1 billion DOGE within 30 days has been achieved.

- 06:45Sonic co-founder Andre Cronje: Over $7 million has been spent to address losses from MultichainJinse Finance reported that Sonic (formerly Fantom) co-founder Andre Cronje stated that the team has invested over $7 million to help victims of the Multichain incident recover their assets, with more than $5 million spent on legal-related expenses. The foundation has recently allocated an additional $2 million to continue advancing related efforts in the United States and China.

- 06:45Scam Sniffer: A malicious attacker has deployed a counterfeit contract highly similar to the Request Finance batch payment contract.Jinse Finance reported, according to Scam Sniffer monitoring, Request Finance has issued a security alert stating, "A malicious attacker has deployed a counterfeit contract that is extremely similar to the Request Finance batch payment contract. One of our clients was affected, but the vulnerability has now been fixed." Possible attack vectors include: application vulnerabilities, malware/browser extension transaction modifications, front-end tampering/DNS hijacking, and other injection methods. The exact attack mechanism remains unclear. Please refer to the official report for detailed investigation results.