News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- U.S. Department of Commerce partners with Chainlink and Pyth to deliver on-chain economic data, sparking divergent market reactions. - Pyth’s PYTH token surges 70% vs. Chainlink’s 5% gain, despite Chainlink’s $20T Total Value Enabled and broader infrastructure. - Chainlink’s institutional adoption and cross-chain scalability position it as a cornerstone for U.S. blockchain strategy, contrasting Pyth’s speculative focus. - Market underappreciation of Chainlink’s fundamentals creates a contrarian opportuni

- Sharps Technology raised $400M to build a Solana treasury, shifting from medical devices to a dual-income model combining staking yields and equity appreciation. - This aligns with Solana’s institutional adoption, leveraging scalability, low costs, and 6.86% staking yields to attract capital amid $1.8B Strategic Solana Reserve growth. - Solana’s TVL reached $11.7B in Q3 2025, but its price remains below the 2025 high, highlighting undervaluation amid regulatory clarity efforts and ETF speculation. - Shar

- MAGACOIN FINANCE emerges as a post-Ethereum asymmetric crypto opportunity with projected 18,000% ROI by 2025. - Its deflationary tokenomics, institutional-grade security, and whale-backed liquidity differentiate from speculative meme coins. - The PATRIOT50X bonus offers 50x multiplier for early presale investors amid rapid sellout rates and capital reallocation trends. - Projected to outperform Ethereum's 14,000% historical ROI, it combines meme-like virality with technical infrastructure resilience.

- CFTC's 2025 settlement reclassified XRP as a commodity, resolving a 3-year legal battle and enabling U.S. institutional trading. - XRP ETF applications (e.g., ProShares' $1.2B Ultra XRP ETF) signal $5-8B potential inflows, with 95% approval probability. - Post-settlement XRP surged to $3.32, showing strong institutional support through futures volume and whale accumulation. - Regulatory clarity and cross-border payment innovations position XRP as a strategic asset for diversified crypto portfolios.

- Civil law jurisdictions like Quebec mandate public beneficial ownership registries, boosting ESG scores and investor trust in platinum producers. - Common law regions face higher volatility due to opaque governance, exemplified by South African producers lagging 18% in risk-adjusted performance. - The 2025 platinum-to-gold ratio surge reflects legal regime impacts, with Quebec firms insulated from tariffs and regulatory shocks. - Investors are advised to prioritize civil law-compliant firms and hedge aga

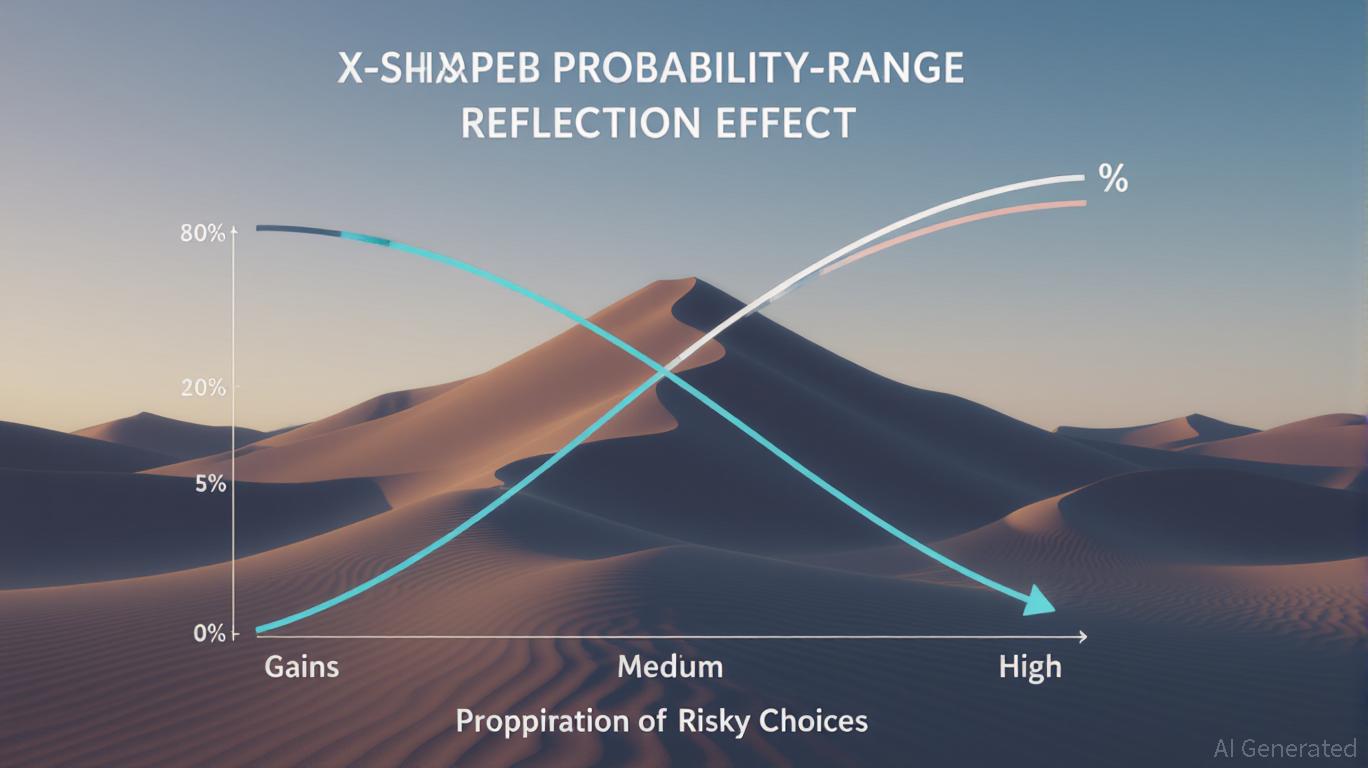

- The reflection effect explains how investors show risk aversion in gains and risk-seeking in losses, reshaping portfolio strategies for assets like SLV and MSTY. - MSTY's 2025 volatility highlights behavioral shifts: risk-averse selling during gains and risk-seeking buying during 30% declines, aligning with prospect theory predictions. - Tactical approaches like hybrid portfolios (MSTY + TIPS) and RSI-based trading reduced volatility, generating 42.22% returns vs. 37.32% benchmarks in 2022-2025. - A 2025

- CME Group's May 2025 XRP Futures launch institutionalized digital assets, offering regulated liquidity and validating XRP's financial role. - SEC's August 2025 ruling cleared XRP's legal status, enabling $17M reallocation from Bitcoin to XRP by Gumi Inc. and boosting institutional adoption. - XRP Futures' $1.6B July 2025 notional volume and transparent pricing mechanism demonstrate growing utility-driven demand over speculation. - Experts project $2.80 XRP price by 2025, citing ETF approval potential, Ri

- SEC's 2025 ruling reclassified XRP as a commodity, resolving a 5-year legal battle and aligning it with Bitcoin under the CLARITY Act. - Institutional adoption surged as XRP processed $1.3T in cross-border payments and enabled $2.9B in tokenized trade via Ripple's ODL and partnerships. - ProShares' $1.2B XRP ETF launch and 11+ pending applications signal potential $5-8B in institutional inflows, mirroring Bitcoin's ETF-driven liquidity surge. - Analysts project XRP could reach $3.65-$5.80 by 2025, driven

- Dogecoin's 2025 price swings exemplify the reflection effect, where investor psychology shifts between risk-seeking and risk-averse behavior based on perceived gains or losses. - A 52% Q3 surge was driven by social media hype, institutional buying, and ETF speculation, amplifying retail investor FOMO despite lacking fundamental value. - The subsequent 4.19% drop highlighted the fragility of bullish sentiment, as panic selling followed a price dip below key technical levels and bearish sentiment rose to 2

- Global silver markets face structural deficits due to geopolitical supply constraints, green energy demand surges, and dollar weakness. - Solar PV and EV adoption drive 30%+ demand growth by 2030, outpacing 2% mine production growth and creating 149M oz annual deficits. - Central bank rate hikes and dollar erosion boost silver's appeal as inflation hedge, with gold-silver ratio at 80:1 signaling undervaluation. - Technical analysis targets $41/oz but warns of historical volatility, urging disciplined ris

- 14:34Tony Welch: Rising Initial Jobless Claims Indicate a Weakening Labor MarketAccording to ChainCatcher, citing Golden Ten Data, SignatureFD analyst Tony Welch stated that higher-than-expected initial jobless claims had a greater impact on the market than the anticipated August inflation. He pointed out that a CPI inflation rate close to 3% is drifting further from the Federal Reserve's 2% target, and the weak PPI indicates that producers may be absorbing tariff costs. Welch believes that the US labor market has not collapsed, which makes it more likely that the Federal Reserve will cut interest rates by 25 basis points next week, rather than the 50 basis points predicted by some analysts.

- 14:34The Dow Jones surpasses 46,000 points, reaching a new all-time high with an intraday gain of over 500 points.According to Golden Ten Data, as reported by ChainCatcher, the Dow Jones broke through the 46,000-point mark, setting a new all-time high. During the session, it rose by more than 500 points, with an increase of 1.12%.

- 14:25BlackRock IBIT Bitcoin holdings market value surpasses $85 billionAccording to official data reported by Jinse Finance, BlackRock's Bitcoin exchange-traded fund IBIT now holds 754,163.2077 bitcoins, with a total market value surpassing $85 billions, reaching $85,881,232,723.45.