News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Bitcoin broke below a key multiyear support trendline, triggering "fakeout" fears as prices rebounded from a seven-week low of $108,665 to $113,208. - Technical analysts highlight conflicting signals: bullish inverse head-and-shoulders patterns vs. bearish double-top warnings and Fibonacci retracement risks. - Institutional selling contrasts with retail buying pressure, stabilizing prices amid a Binance Fear & Greed Index of 45 (moderate anxiety). - $117,000–$118,000 is the next critical target, with pot

- Elon Musk's lawyer Alex Spiro will chair a $200M Dogecoin treasury company backed by Miami-based House of Doge. - The initiative aims to institutionalize Dogecoin's market presence through traditional stock market exposure and corporate legitimacy. - Dogecoin's value remains heavily influenced by Musk's public statements, with the treasury model following crypto trends seen in Bitcoin investments. - Critics warn of regulatory risks and market manipulation concerns despite the growing $132B crypto treasur

- Bitcoin shows triple on-chain signals (whale selling decline, HODL Waves accumulation, technical support) suggesting a potential 4% price surge to $119,000. - Whale Exchange ratio dropped to 0.43 (lowest in two weeks), indicating reduced large-holder selling pressure and retail buyer dominance. - Medium-term holders increased BTC holdings despite volatility, reinforcing confidence in long-term price resilience. - Technical analysis highlights $115,400 support and $119,700 resistance levels as critical fo

- SPX token fell 12% as whale selling and weak technical indicators dominate bearish sentiment. - Institutional accumulation at $1.15 suggests contrarian buying, contrasting with Bitcoin/Ethereum's stable treasury growth. - $1.15 support zone faces pressure from massive whale offloading, with historical RSI strategies showing 145% returns but 25% drawdowns. - Market hinges on whether institutional confidence can outweigh bearish momentum and validate $1.15 as a recovery catalyst.

- Wall Street Pepe (WEPE) redefines meme coins through dual-chain migration (Ethereum/Solana) and deflationary tokenomics, addressing volatility and utility gaps seen in Dogecoin and Shiba Inu. - Its cross-chain model burns Ethereum tokens with every Solana transaction, maintaining a fixed 200 billion supply and enabling 1:1 peg activation at $0.001 per token. - NFT integration grants governance rights and exclusive perks (e.g., Alpha Chat access), creating a flywheel effect that links NFT adoption to toke

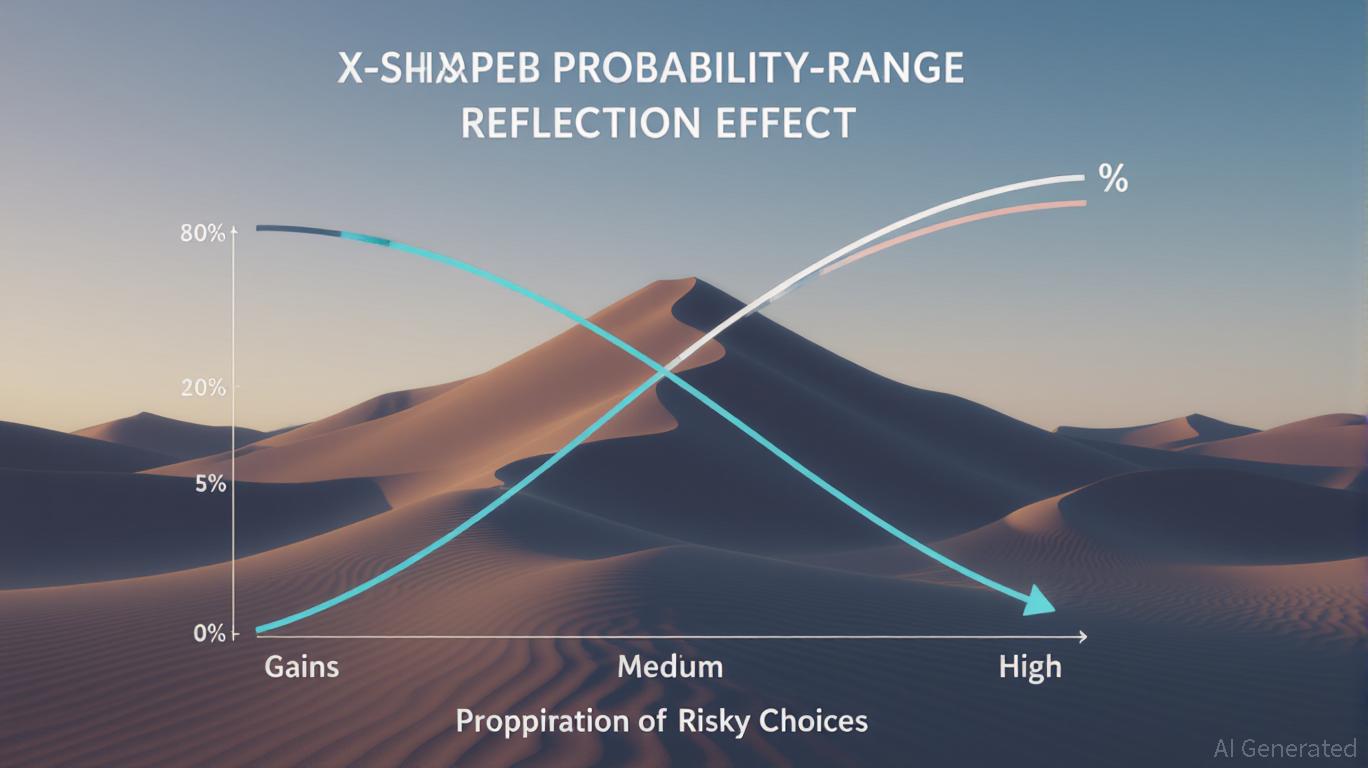

- The probability-range reflection effect (UXRP) explains how investors' risk preferences shift across six domains based on probability levels and gain/loss contexts. - Low-probability losses trigger risk-seeking behavior (e.g., distressed assets), while high-probability gains favor risk-averse choices (e.g., stable dividends). - Strategic allocations vary by scenario: defensive assets in stable markets, contrarian plays during downturns, and diversified hedging in uncertain conditions. - Domain-specific a

- Pepenode ($PEPENODE), a mine-to-earn meme coin, raises $500K in presale with whale support, offering hardwareless Ethereum-based mining via virtual nodes. - Users earn tokens through interactive node upgrades, with 70% token burn on upgrades creating deflationary scarcity and 2% referral rewards driving viral growth. - Positioned as a "next-gen Pepe coin," it combines gamification with utility, contrasting speculative meme coins by linking value to user activity and cross-token rewards. - With 14,854 pre

- U.S. "de minimis" tariff exemption removal hikes costs for consumers and businesses, targeting imports under $800. - Small businesses face financial strain, resorting to layoffs or alternative revenue streams to offset rising import duties. - Global South economies risk destabilization as U.S. tariffs disrupt cheap export markets, prompting currency devaluation fears. - IMF and OECD cut 2025 growth forecasts, citing tariff-driven uncertainty and uneven corporate impacts like Nike's $100M+ cost hikes.

- Japanese firm Gumi invests $17M in XRP for cross-border payments and liquidity via SBI partnership. - Growing institutional adoption includes $20M-$500M XRP allocations by firms like Nature’s Miracle and Trident, shifting from speculation to operational use. - SEC’s 2024 XRP commodity reclassification spurred 92 ETF filings in 2025, projecting $4.3–$8.4B inflows and reduced regulatory risks. - XRP’s sub-5-second settlement and $0.0004 fees outperform SWIFT, with Ripple’s ODL processing $1.3T in Q2 2025 t

- 2025 crypto market shifts via meme culture, Layer 2 solutions, and hyper-engaged communities driving value creation. - HYPER (Bitcoin Layer 2) and LILPEPE (Ethereum meme coin) lead with scalability, zero-tax mechanics, and 205%-2,600% staking APYs. - MAXI targets traders with gamified incentives while WEPE merges meme virality with financial education to build long-term utility. - Projects like MOBU leverage exclusivity and low fees to address Ethereum's scalability challenges, attracting developers and

- 21:22Polygon: Milestone issue fix has been released, and the root cause of the final confirmation issue has been identified.Foresight News reported that the Polygon Foundation has released an update stating that the Milestone issue fix has been published. The root cause of the final confirmation issue has been identified, and version v2.2.11-beta2 has been released for Bor, while version v0.3.1 has been released for Heimdall, the latter being a hard fork scheduled to be implemented at 11:00 (UTC+8). The network's operational status will continue to be monitored to ensure all issues are resolved.

- 21:22Black Mirror: The first phase of MIRROR TGE airdrop distribution has been completedForesight News reported that Black Mirror announced the first phase of the MIRROR TGE airdrop distribution has been completed, with the initial 10% unlock finalized. The staking and unlocking portal will be launched soon, where users can claim their remaining allocations (provided they still hold eligible NFTs), select their unlocking preferences, and lock their tokens.

- 21:20Texas man operating cryptocurrency "Ponzi scheme" denied bankruptcy discharge for $12.5 million debtJinse Finance reported that the U.S. Bankruptcy Court for the Southern District of Texas recently rejected the bankruptcy exemption request of local resident Nathan Fuller, requiring him to bear the full responsibility for his debt of over $12.5 million and any future creditor claims. Fuller previously operated the cryptocurrency investment company Privvy Investments LLC, allegedly running a Ponzi scheme to attract funds, using investors' money to purchase luxury goods, pay for gambling trips, and even buy nearly $1 million in real estate for his ex-wife. In October 2024, after being sued by investors, Fuller filed for Chapter 7 bankruptcy protection in an attempt to discharge his debts. The United States Trustee Program (USTP) investigation found that Fuller concealed assets, forged documents, made false statements during the bankruptcy case, and was held in civil contempt for refusing to comply with court orders. He later admitted to operating a Ponzi scheme and interfering with the bankruptcy process. As Fuller did not respond to the USTP's allegations, the court issued a default judgment in August this year and has now officially denied his debt exemption request.