News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

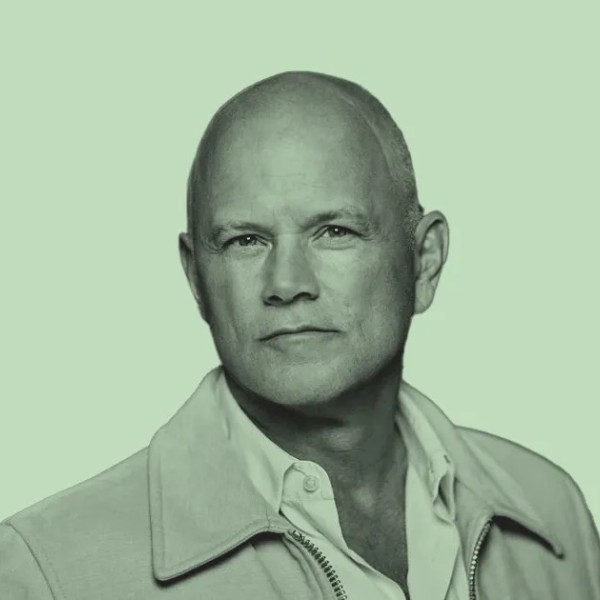

Novogratz has never been a typical Wall Street person.

Aave Labs introduces Horizon, a new RWA lending market on Ethereum allowing institutions to borrow stablecoins using real-world assets.How Aave Horizon WorksAave’s Vision for Institutional DeFi

USDT dominance breaks key support, signaling a massive altcoin rotation. History suggests this could trigger explosive altcoin gains.USDT Dominance Break Signals Altcoin BoomLiquidity Rotation: From Safety to SpeculationThe Cycle Is Repeating

Ethereum hits $4,800 target, signaling a shift from accumulation to expansion. $6K+ may be next if momentum holds.Ethereum Hits Targets, Enters Expansion PhaseWhat’s Driving Ethereum’s Momentum?Don’t Chase Later – Position Now?

A head and shoulders pattern in BTC dominance may signal an upcoming altcoin rally.BTC Dominance Pattern Hints at Altcoin SeasonWhat Is a Head and Shoulders Pattern?What This Means for Altcoins

Arthur Hayes forecasts explosive growth for HYPE, ENA, ETHFI by 2028 and hails Codex as the future of crypto banking.Codex: The Future of Crypto Banking?Should You Bet on Hayes’ Forecast?

The total stablecoin market cap reaches a new all-time high of $280B, signaling renewed confidence in digital dollars.USDT and USDC Continue to DominateWhat This Signals for the Market

- Bitmine Immersion (BMNR) holds $6.6B in ETH, leveraging Delaware's flexible common law and Quebec's civil law transparency for governance. - Delaware's self-reported disclosures create opacity risks, while Quebec's ARLPE mandates real-time UBO registration via REQ for institutional trust. - BMNR adopts Quebec's AMF audit requirements for ETH holdings, aligning with ESG standards and attracting $280M in 2025 Canadian pension investments. - The hybrid model balances Delaware's capital-raising agility with

- Fidelity's Ethereum ETP (FETH) leverages behavioral economics, particularly the reflection effect, to influence investor decisions and market dynamics. - The ETP's volatility reflects risk-averse selling during losses and risk-seeking buying during gains, creating self-reinforcing price cycles. - Fidelity's regulatory alignment and institutional-grade infrastructure reduce perceived risks, attracting both risk-averse and risk-seeking investors. - Investors are advised to counter-cyclical strategies, buyi

- 01:52An Ethereum ICO whale deposited 3,500 ETH, worth approximately $15.11 million, to an exchange within three days.According to Jinse Finance, on-chain analyst Ai Aunt (@ai 9684xtpa) monitored that an Ethereum ICO whale accumulated 2,000 ETH on September 2, and in the past three days has deposited a total of 3,500 ETH to a certain exchange, worth approximately $15.11 million. When this whale withdrew ETH from the exchange, the price was $4,396.23. If this portion was indeed purchased, the loss would be about $155,000.

- 01:46A certain whale closed an ETH long position with a loss of $35.39 million and switched to opening a BTC short position worth $122.6 million.According to Jinse Finance, Onchain Lens monitoring shows that a whale account holding a 15x leveraged ETH long position has closed the position, incurring a book loss of $35.39 million. The account then switched to opening a 25x leveraged BTC short position, totaling 1,106.93 BTC, valued at approximately $122.6 million.

- 01:12Eric Trump: "Debanking" is the catalyst for his family's entry into the digital asset sectorJinse Finance reported that @AmericanBTC co-founder and Chief Strategy Officer Eric Trump stated, "De-banking is 100% a catalyst," prompting his family to enter the digital asset space. In an interview, Eric Trump praised cryptocurrency innovators and emphasized the spirit of "American initiative" involved in their participation.