News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

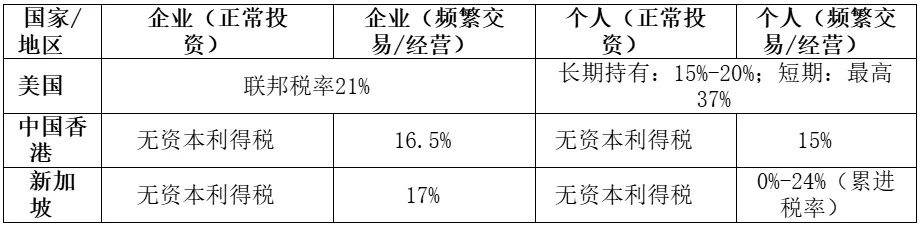

Tax arrangements are not a one-size-fits-all formula but need to be "tailor-made" according to the specific circumstances of each enterprise.

- Ethereum’s price resilience and institutional adoption drive Tom Lee’s $60,000 5-year forecast, supported by $27.6B ETF inflows and 55.5% market dominance. - Regulatory clarity (SEC approval, CLARITY Act) and 29% staked ETH bolster institutional confidence, while Layer 2 upgrades boost scalability and TVS to $16.28B. - Macroeconomic tailwinds (Fed rate cuts) and Ethereum’s role in stablecoins (55% market share) position it as a foundational asset, though competition and volatility pose risks.

- Bitcoin faces critical $110K–$112K resistance as on-chain metrics and institutional dynamics clash over bullish vs. bearish trajectories. - Taker-Buy-Sell ratio (-0.945) signals bearish pressure, while MVRV compression (1.0) suggests potential bull market rebalancing. - Institutional buyers accumulate during dips, offsetting whale-driven selling and ETF outflows amid $30.3B futures open interest. - Fed rate cut expectations and geopolitical risks create macro uncertainty, with 200-day SMA ($100K–$107K) a

- XRP faces a $3.08 breakout threshold, with technical indicators and institutional buying signaling potential for a $5.85 surge. - Post-SEC settlement, 60+ institutions now use XRP for cross-border payments, processing $1.3T via Ripple's ODL in Q2 2025. - $1.1B in institutional XRP purchases and seven ETF providers targeting $4.3B-$8.4B inflows by October 2025 reinforce bullish momentum. - A $3.65 price break would invalidate bearish patterns, while $50M+ weekly institutional inflows could validate the $5

Compared to the treasuries of Ethereum or Bitcoin, the SOL treasury is more efficient in absorbing the current trading supply.

Bitcoin and Ethereum face $14.6 billion in expiring options today, with prices expected to test max pain levels amid Nvidia-driven uncertainty.

- XRP faces a critical juncture with $3.7B CME futures open interest, reflecting institutional confidence post-SEC commodity reclassification in August 2025. - Seven ETF providers filed XRP ETF applications, potentially unlocking $4.3B-$8.4B in inflows if approved by October 2025, mirroring Bitcoin/Ethereum ETF success. - Technical analysis shows XRP consolidating in a $2.85-$3.10 triangle with $3.05 key resistance; analysts project $3.40+ breakout if volume sustains above this level. - Whale accumulation

- ABTC and Gryphon merged via reverse merger to accelerate growth, preserving 98% ownership and avoiding IPO dilution. - Trump family endorsements bolster ABTC's pro-crypto narrative, enhancing political credibility and regulatory influence. - AI-driven HPC and energy-efficient mining position the merged entity to optimize costs in a post-halving market. - Global expansion plans target Hong Kong and Japan, leveraging AI tech to diversify into cloud computing and blockchain solutions. - The merger aligns ca

- 11:51Tether CEO: No Bitcoin has been sold, only part of the reserves have been allocated to XXIJinse Finance reported that Tether CEO Paolo Ardoino stated on the X platform: "Tether has not sold any bitcoin, but has allocated part of its bitcoin reserves to XXI. As the world becomes increasingly uncertain, Tether will continue to invest part of its profits in safe assets such as bitcoin, gold, and land. Tether is a stable company."

- 11:21ether.fi Foundation: 73 ETH of protocol revenue was used this week to purchase 264,000 ETHFIChainCatcher news, the ether.fi Foundation released an ETHFI token buyback update on the X platform, disclosing that it has used 73 ETH (approximately $314,000) of protocol revenue to purchase 264,000 ETHFI. In addition, about 155,000 ETHFI have been burned, and approximately 108,000 ETHFI have been distributed to sETHFI holders.

- 10:52Analysis: Venezuela's inflation rate reaches 229%, USDT becomes the preferred local settlement methodJinse Finance reported that as Venezuela's annual inflation rate soared to 229%, stablecoins such as USDT have become the "de facto" currency for millions of Venezuelans within the financial system. It is reported that locals refer to Bitcoin as "exchange dollars," while the country's currency, the bolivar, has virtually disappeared from daily commercial activities. Hyperinflation, strict capital controls, and a fragmented exchange rate system have led people to increasingly prefer stablecoins over cash or local bank transfers. From small grocery stores to medium-sized businesses, USDT has replaced fiat cash as the preferred settlement method locally.