News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Mutuum Finance (MUTM) has become a DeFi focus, raising $15M in presale phase 6 with 15,720 holders. - MUTM's dual-lending model (P2C/P2P) and deflationary tokenomics contrast with ADA's stagnant growth and traditional altcoin structures. - Projected 400%+ returns at listing and 100x potential over time attract investors amid ADA's $0.87 plateau and delayed ETF approval. - mtUSD stablecoin and cross-chain expansion to Ethereum/BNB Chain aim to enhance utility, while CertiK's 95.0 trust score boosts instit

- Hong Kong’s 2025 Stablecoins Ordinance mandates licensing, 25M HKD capital, and reserve segregation for fiat-backed stablecoin issuers, positioning the city as a crypto-regulatory leader. - The framework diverges from U.S. and EU models by prioritizing institutional access over retail, aligning with EU reserve standards while enforcing localized licensing and physical presence requirements. - Critics warn of innovation stifling due to high barriers, while proponents highlight its appeal to institutional

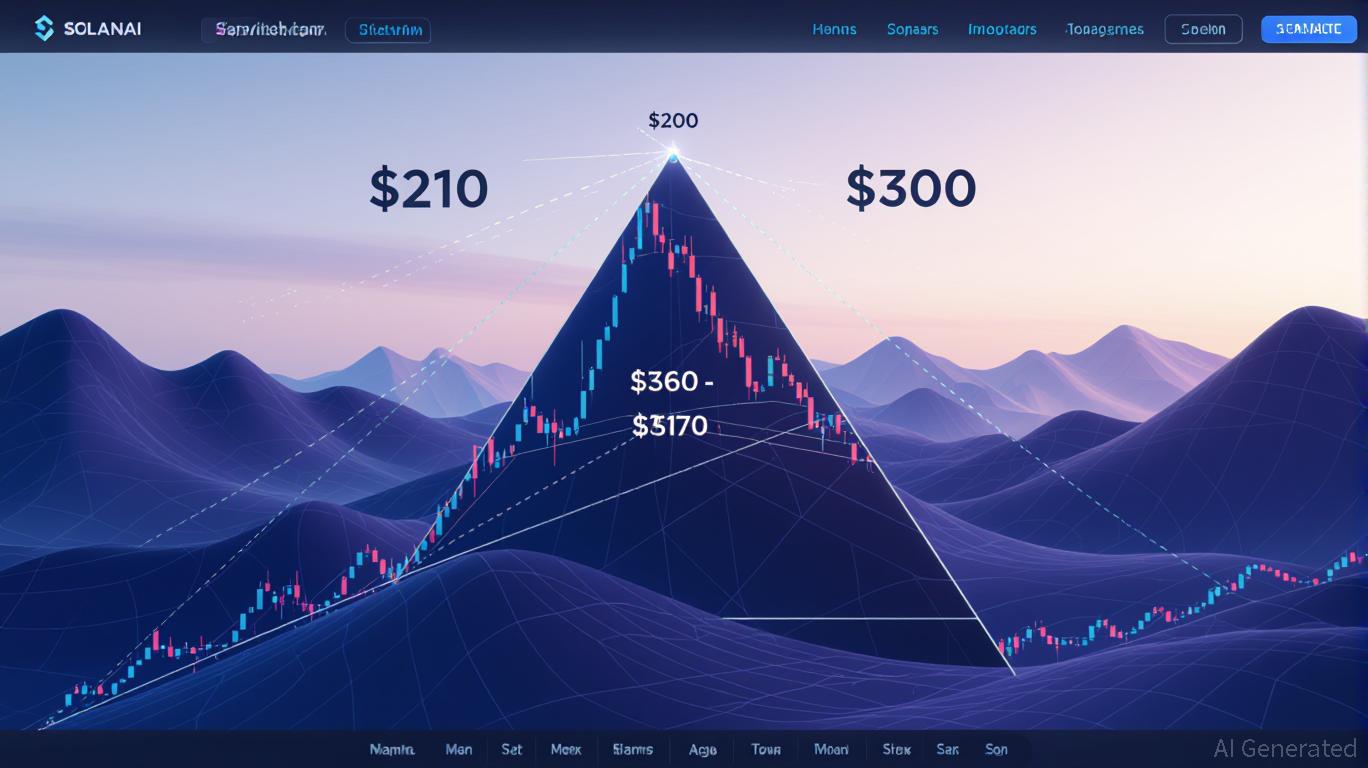

- Solana (SOL) gains institutional traction with $1.72B staking inflows and 13 public companies staking 8.277M tokens at 6.86% yields. - Technical indicators suggest $300 price target if $215 resistance breaks, supported by $2.35B futures volume and Fibonacci projections. - Whale accumulation and $12.9B open interest signal bullish positioning, while institutional $1B buy-in rumors could bridge valuation gaps. - Risks include $185 support breakdown, but $180-190 range offers strategic entry with macro opti

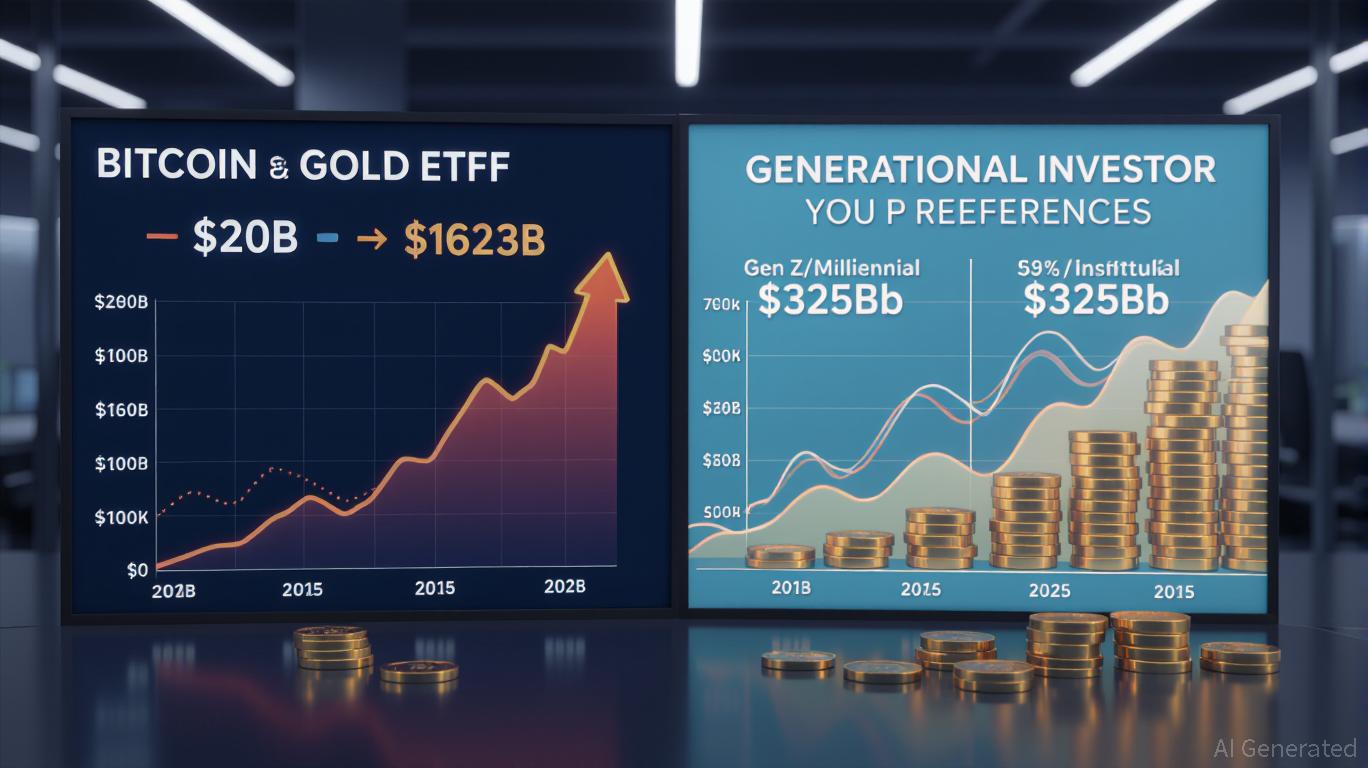

- Bitcoin and gold ETFs combined AUM surpassed $500B in 2025, with Bitcoin surging to $162B and gold at $325B. - Bitcoin ETFs grew 810% in 10 months post-SEC approval, while gold ETFs doubled amid central bank demand and de-dollarization trends. - Generational divides persist: 73% of Gen Z/Millennials prefer Bitcoin, while 59% of institutions allocate 10%+ to Bitcoin ETFs. - Gold retains stability during crises (e.g., $3.2B July inflows) and maintains institutional trust as a millennia-old store of value.

- Ethereum ETFs surged with $1.83B inflows over five days in August 2025, outpacing Bitcoin ETFs’ $800M outflows. - Institutional adoption favors Ethereum’s 4–6% staking yields, regulatory clarity as a utility token, and Dencun/Pectra upgrades boosting DeFi scalability. - Ethereum ETFs now hold $30.17B AUM (vs. Bitcoin’s $54.19B), with 68% Q2 2025 growth in institutional holdings and 60% allocation in yield-optimized portfolios. - Bitcoin’s 57.3% market share faces erosion as investors prioritize Ethereum’

Pi Coin enters September under heavy pressure, with selling and Bitcoin correlation threatening new lows unless $0.362 is reclaimed.

- Hong Kong enacted the Stablecoins Ordinance (Cap. 656) on August 1, 2025, establishing a legal framework for fiat-referenced stablecoins to position the city as a global digital asset hub. - The ordinance mandates HKMA licensing for stablecoin issuers, requiring HK$25 million minimum capital and full backing by high-quality liquid assets like government bonds. - Strict AML/cybersecurity protocols and market reactions, including BitMart withdrawing VASP applications, highlight the regulatory rigor balanci

- U.S. Department of Commerce partners with Chainlink and Pyth to publish macroeconomic data on blockchain networks, enhancing transparency and tamper-proof integrity. - Key indicators like GDP and PCE are now accessible via onchain feeds, enabling DeFi applications to integrate real-time economic metrics for dynamic financial tools. - The initiative drives institutional blockchain adoption, with Pyth and Chainlink tokens surging post-announcement, reflecting growing trust in decentralized data infrastruct

- Gryphon's stock jumped 42.1% to $1.75 as merger with American Bitcoin nears, with shares up 231% since May. - Post-merger entity retains ABTC ticker, controlled by Trump family (98%) and Hut 8, with Winklevoss brothers as anchor investors. - Strategic move aligns with 2025 crypto IPO surge, including Circle and Bullish, amid U.S. policy shifts like the GENIUS Act. - Merged entity aims to expand BTC reserves through Asian acquisitions, leveraging $5B securities filing for growth-focused capitalization.

- 21:22OpenMind has launched an app and will conduct Season 1 points activities weekly through user participation.Foresight News reported that OpenMind has announced the launch of its application, now available for iOS and Android. Starting from September 10, the official team will invite users from the waitlist to participate in Season 1’s points campaign every week.

- 21:22Asset Entities approves merger with Strive to establish a $1.5 billion BTC financial companyForesight News reported, according to CoinDesk, that following shareholder approval from Strive on September 4, Asset Entities Inc (ASST) announced that its shareholders have approved a merger with Strive Enterprises. The merged company will be renamed Strive Inc. and will implement a bitcoin fund management strategy. Matt Cole, the current head of Strive Asset Management, will serve as chairman and CEO of the merged company, while Asset Entities President and CEO Arshia Sarkhani will transition to Chief Marketing Officer and board member. Strive expects to complete a $750 million private investment in public equity (PIPE) financing after the transaction, and if warrants are exercised, the potential total proceeds could exceed $1.5 billion.

- 21:22Polygon: Milestone issue fix has been released, and the root cause of the final confirmation issue has been identified.Foresight News reported that the Polygon Foundation has released an update stating that the Milestone issue fix has been published. The root cause of the final confirmation issue has been identified, and version v2.2.11-beta2 has been released for Bor, while version v0.3.1 has been released for Heimdall, the latter being a hard fork scheduled to be implemented at 11:00 (UTC+8). The network's operational status will continue to be monitored to ensure all issues are resolved.