News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

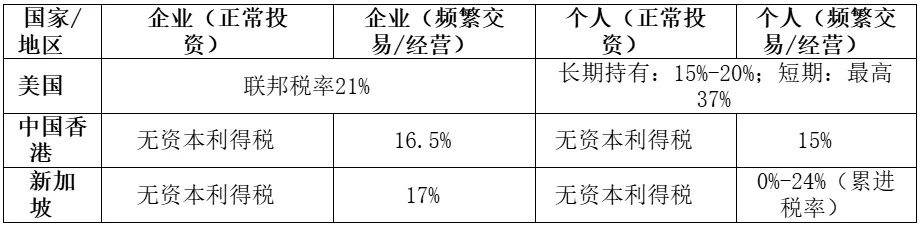

Tax arrangements are not a one-size-fits-all formula but need to be "tailor-made" according to the specific circumstances of each enterprise.

- Ethereum’s price resilience and institutional adoption drive Tom Lee’s $60,000 5-year forecast, supported by $27.6B ETF inflows and 55.5% market dominance. - Regulatory clarity (SEC approval, CLARITY Act) and 29% staked ETH bolster institutional confidence, while Layer 2 upgrades boost scalability and TVS to $16.28B. - Macroeconomic tailwinds (Fed rate cuts) and Ethereum’s role in stablecoins (55% market share) position it as a foundational asset, though competition and volatility pose risks.

- Bitcoin faces critical $110K–$112K resistance as on-chain metrics and institutional dynamics clash over bullish vs. bearish trajectories. - Taker-Buy-Sell ratio (-0.945) signals bearish pressure, while MVRV compression (1.0) suggests potential bull market rebalancing. - Institutional buyers accumulate during dips, offsetting whale-driven selling and ETF outflows amid $30.3B futures open interest. - Fed rate cut expectations and geopolitical risks create macro uncertainty, with 200-day SMA ($100K–$107K) a

- XRP faces a $3.08 breakout threshold, with technical indicators and institutional buying signaling potential for a $5.85 surge. - Post-SEC settlement, 60+ institutions now use XRP for cross-border payments, processing $1.3T via Ripple's ODL in Q2 2025. - $1.1B in institutional XRP purchases and seven ETF providers targeting $4.3B-$8.4B inflows by October 2025 reinforce bullish momentum. - A $3.65 price break would invalidate bearish patterns, while $50M+ weekly institutional inflows could validate the $5

Compared to the treasuries of Ethereum or Bitcoin, the SOL treasury is more efficient in absorbing the current trading supply.

Bitcoin and Ethereum face $14.6 billion in expiring options today, with prices expected to test max pain levels amid Nvidia-driven uncertainty.

- XRP faces a critical juncture with $3.7B CME futures open interest, reflecting institutional confidence post-SEC commodity reclassification in August 2025. - Seven ETF providers filed XRP ETF applications, potentially unlocking $4.3B-$8.4B in inflows if approved by October 2025, mirroring Bitcoin/Ethereum ETF success. - Technical analysis shows XRP consolidating in a $2.85-$3.10 triangle with $3.05 key resistance; analysts project $3.40+ breakout if volume sustains above this level. - Whale accumulation

- ABTC and Gryphon merged via reverse merger to accelerate growth, preserving 98% ownership and avoiding IPO dilution. - Trump family endorsements bolster ABTC's pro-crypto narrative, enhancing political credibility and regulatory influence. - AI-driven HPC and energy-efficient mining position the merged entity to optimize costs in a post-halving market. - Global expansion plans target Hong Kong and Japan, leveraging AI tech to diversify into cloud computing and blockchain solutions. - The merger aligns ca

- 16:29JPMorgan: The Federal Reserve will cut interest rates by 25 basis points next weekChainCatcher news, according to Golden Ten Data, JPMorgan US economist Michael Feroli expects that the Federal Reserve will cut interest rates by 25 basis points next week. He pointed out that there are two to three dissenters who support a larger rate cut, but no one supports keeping rates unchanged. The dot plot is still expected to show another rate cut after 2025.

- 16:23U.S. Secretary of Commerce: Musk misunderstood DOGE's goal—the focus is not on layoffs, but on reducing expensesJinse Finance reported that U.S. Secretary of Commerce, Luttig, stated that Musk misunderstood the objectives of the Department of Government Efficiency (DOGE). He focused on layoffs rather than truly reducing government spending waste.

- 16:10RWA institution Centrifuge has issued some assets on Solana.Jinse Finance reported that leading RWA tokenization institution Centrifuge has launched tokenized assets deJAAA and deJTRSY on Solana. Users can trade them on Raydium, Kamino, and other DEX aggregators.