News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- 2025 crypto success hinges on community-driven tokens with strategic partnerships, blending innovation and transparent growth. - Arctic Pablo Coin (APC) leads with deflationary mechanics, institutional audits, and 12,400% ROI potential via NFTs and DAO governance. - MoonBull ($MOBU) leverages Ethereum infrastructure and whitelist scarcity, offering Ethereum-grade security with AI-driven DeFi features. - Bitcoin Hyper ($HYPER) addresses Bitcoin's scalability via Solana's SVM, raising $12.5M with WBTC brid

- 2025 meme coin market evolves from viral humor to technical competition, with $74.5B valuation driven by tokenomics, scarcity, and DeFi integration. - Whitelist projects like MoonBull ($MOBU) and Arctic Pablo Coin (APC) create urgency via exclusive access, deflationary mechanisms, and private staking rewards. - ROI hinges on structured tokenomics and blockchain utility, as seen in MoonBull's Ethereum staking and Pepe Coin's NFT partnerships. - High-risk factors persist, including pump-and-dump schemes, b

- Hyperliquid’s HYPE token repurchased 8.7% of supply via $1.26B buybacks and burned 3,200 tokens in 24 hours, tightening float and creating bullish bias. - Whale wallets spent $35.9M to accumulate 641,551 HYPE tokens, driving 2.5–5.8% price surges and signaling institutional coordination. - Technical indicators show sustained upward momentum, with HYPE gaining 7.5% in August despite broader market declines, supported by $105M fee-funded buybacks. - Risks include Bitcoin correlation and whale manipulation

- Ethereum's institutional adoption accelerated in 2025 as corporate treasuries and ETFs controlled 9.2% of its supply, reshaping market dynamics. - 19 public companies and BlackRock's ETHA ETF dominated inflows, with $17.6B in corporate holdings and $27.66B in ETF assets by Q3 2025. - Regulatory clarity and yield-generating strategies reduced circulating supply, enhancing price resilience and positioning Ethereum as a regulated institutional asset. - Institutional accumulation created a flywheel effect, r

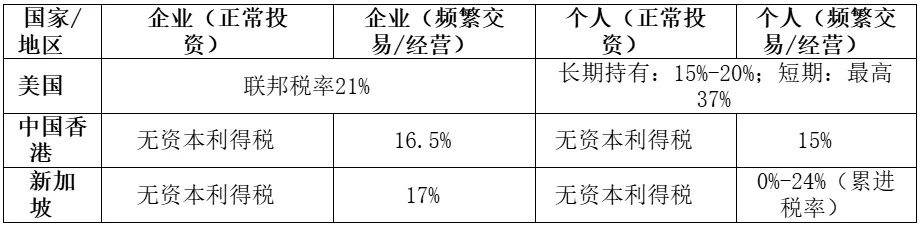

Tax arrangements are not a one-size-fits-all formula but need to be "tailor-made" according to the specific circumstances of each enterprise.

- Ethereum’s price resilience and institutional adoption drive Tom Lee’s $60,000 5-year forecast, supported by $27.6B ETF inflows and 55.5% market dominance. - Regulatory clarity (SEC approval, CLARITY Act) and 29% staked ETH bolster institutional confidence, while Layer 2 upgrades boost scalability and TVS to $16.28B. - Macroeconomic tailwinds (Fed rate cuts) and Ethereum’s role in stablecoins (55% market share) position it as a foundational asset, though competition and volatility pose risks.

- 09:29Data: EXO market cap surpasses 110 million USD, up over 770% in the past 24 hoursAccording to ChainCatcher, based on GMGN data, EXO's market capitalization briefly surpassed 110 million US dollars and is now reported at 105 million US dollars, with an intraday increase of over 770%. Meme coin prices are highly volatile, so investors are advised to participate with caution.

- 09:29USDT market capitalization surpasses $170 billion, reaching a new all-time highJinse Finance reported that, according to the latest data from Coingecko, the market capitalization of the US dollar stablecoin USDT, issued by stablecoin issuer Tether, has surpassed 170 billions USD, currently reaching 170,085,261,371 USD, setting a new all-time high. The trading volume in the past 24 hours reached 102,711,488,564 USD.

- 08:45Kame Aggregator was hacked this morning, and the attacker has returned 185 ETH.According to Jinse Finance, the Sei trading aggregator Kame Aggregator has officially announced that it has successfully reached an agreement with the hacker, who has agreed to return the stolen funds. Through an Ethereum transaction, 185 ETH has already been recovered and returned to the platform. Kame Aggregator stated that it is currently collecting relevant information from affected users and will soon announce a detailed compensation plan.