News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

In Brief Arthur Hayes rapidly ramps up altcoin purchases amid market optimism. His acquisitions include Ethereum, Pendle, Lido DAO, and Ether.fi. Market sentiment shifts to "greed" territory, aligning with Hayes’s strategic timing.

In Brief HBAR displays a sideways trend, declining 2% in 24 hours against market uptrends. Coinglass data shows $6.42 million outflows, indicating cautious investor sentiment. Technical indicators suggest continued weakening, with potential price pressure intensifying.

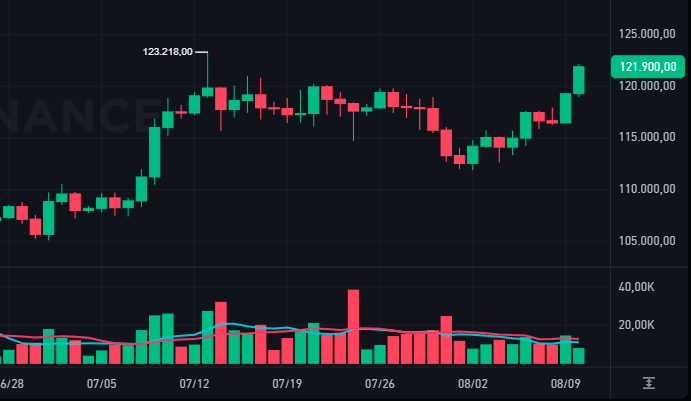

Whales have been accumulating Chainlink, Cardano, and PEPE in anticipation of the US CPI release, with LINK rising by 30%, ADA reaching a 14-day high, and PEPE seeing a 17% increase.

Global M2 money supply is climbing again, raising hopes for a potential Bitcoin price surge.Why M2 Matters for CryptoThe Road Ahead for BTC

Etherex sees a massive 503% TVL surge in 7 days, hitting $119.6M on Ethereum Layer 2 network Linea.What’s Driving the Surge?Implications for DeFi and Layer 2 Adoption

Large investors are scooping up millions in Chainlink, signaling rising confidence in LINK’s future.Millions Spent in Hours on LINKWhat This Means for the Market

- 04:11Data: Bitcoin spot ETF saw a total net outflow of $51.2824 million yesterday, marking the first net outflow after net inflows over the past 7 days.ChainCatcher News, according to SoSoValue data, the total net outflow of bitcoin spot ETFs yesterday was $51.2824 million. The bitcoin spot ETF with the highest single-day net inflow yesterday was Blackrock ETF IBIT, with a single-day net inflow of $150 million. The historical total net inflow of IBIT has reached $60.399 billion. The second was Grayscale Bitcoin Mini Trust ETF BTC, with a single-day net inflow of $22.5353 million, and the historical total net inflow of BTC has reached $1.837 billion. The bitcoin spot ETF with the highest single-day net outflow yesterday was Fidelity ETF FBTC, with a single-day net outflow of $116 million. The historical total net inflow of FBTC has reached $12.564 billion. As of press time, the total net asset value of bitcoin spot ETFs is $152.453 billion, the ETF net asset ratio (market value as a percentage of total bitcoin market value) is 6.62%, and the historical cumulative net inflow has reached $57.332 billion.

- 04:11Data: The current Crypto Fear & Greed Index is 51, indicating a neutral state.ChainCatcher news, according to Coinglass data, the current cryptocurrency Fear and Greed Index is 51, down 3 points from yesterday. The 7-day average is 53, and the 30-day average is 50.

- 03:56Bloomberg ETF analyst: Over 100 crypto ETFs may be launched in the next 12 monthsChainCatcher reported that Bloomberg ETF analyst Eric Balchunas stated on X that after the US SEC implemented universal ETF listing standards last time, the number of ETF listings doubled. Therefore, it is very likely that we will see more than 100 crypto ETFs listed in the next 12 months. According to market sources, the SEC has approved exchanges to adopt universal listing standards for crypto spot ETFs, with the shortest approval period being about 75 days.