News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (May 7)|New Hampshire Passes Strategic Bitcoin Reserve Bill; FOMC Decision & Powell’s Speech May Act as Catalysts2Bitcoin hits $97K as China injects $138B and Fed ramps bond purchases3SUI Cryptocurrency Surpasses Expectations and Challenges Cardano in Layer 1 Blockchain Competition

US Bitcoin ETFs Attract $2 Billion in July, Surpass 900,000 BTC in Holdings

BeInCrypto·2024/07/21 10:31

Bitcoin Price Analysis: Here’s the Next Target for BTC Before Bulls Can Hope for $70K

Cryptopotato·2024/07/21 07:47

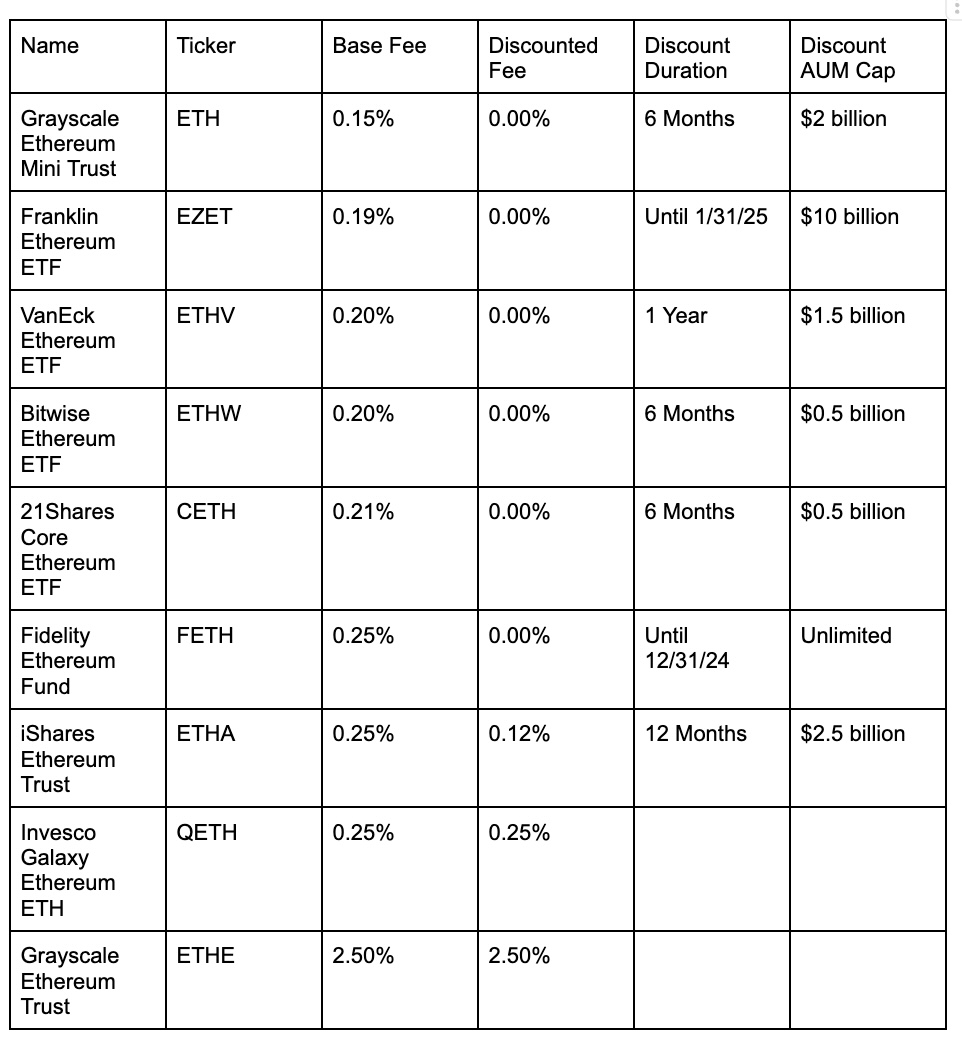

Ethereum ETFs are coming — Here’s what you need to know

Are you ready for the July 23 launch of nine spot Ethereum ETFs? Here's what you need to know to start trading.

Cointelegraph·2024/07/20 19:52

Ethereum’s spot ETFs will trigger a dip, not a rally

Share link:In this post: Ethereum’s supply has been increasing by 60,000 ETH per month since April, which could lead to a market dip instead of a rally when spot ETFs are introduced. Historical patterns from 2016 and monetary policy trends suggest that ETH/BTC might see a huge drop before potentially rising next year. Benjamin Cowen warns that if the current supply trend continues, Ethereum’s supply will revert to pre-Merge levels by December 2024.Disclaimer. The information provided is not trading advice.

Cryptopolitan·2024/07/20 18:13

If Joe Biden bails on the presidential race, what’s next?

Cryptopolitan·2024/07/20 18:13

Is It Too Late To Buy TURBO? Turbo Price Skyrockets 45% As Traders Rush To Buy This AI Crypto Before It’s Too Late

Insidebitcoin·2024/07/20 17:56

Bitcoin Shines as ‘Blue Screen of Death’ Cripples Global Systems: Senator Lummis Reacts

Coinedition·2024/07/20 14:55

The Trump Effect: Bitcoin, Solana, XRP Soar on Renewed Investor Optimism

Coinedition·2024/07/20 14:55

Bitcoin Whales Signal Bullish Trend: $5.6 Million Options Bet Fuels Price Rally

Coinedition·2024/07/20 14:55

Can Ethereum ETFs Propel ETH Price to $4,000?

Newscrypto·2024/07/20 14:52

Flash

- 22:10Federal Reserve's Powell: In Some Cases, a Rate Cut This Year is AppropriateFederal Reserve Chairman Powell stated that in some cases, it is appropriate to cut interest rates this year, while in other cases, it is not appropriate. I cannot confidently say that I know the appropriate path for interest rates.

- 22:09Powell: The Impact of Tariffs Has Been Much Greater Than Expected So FarAccording to a report by Jinse Finance, Federal Reserve Chairman Powell stated that survey respondents identified tariffs as the main factor driving inflation expectations. The impact of tariffs has been much greater than anticipated so far. If the significant increase in tariffs continues as announced, higher inflation and lower employment will occur. Avoiding sustained inflation will depend on the scale, timing, and inflation expectations of the tariffs.

- 22:09Summary of the Fed's FOMC Statement and Powell's Speech: Trump's Call for Rate Cuts Has No Impact on the Fed's WorkThe Federal Reserve announced that it will maintain the federal funds rate target range at 4.25% to 4.50%, marking the third consecutive time since January this year that the Fed has kept rates unchanged. The FOMC statement indicates that the committee judges the risks of rising unemployment and inflation have intensified. Inflation remains slightly elevated. The uncertainty of the U.S. economic outlook has further increased. Economic activity continues to expand at a robust pace. Powell stated that the Fed does not need to rush to adjust rates. The Fed's policy is moderately restrictive. Trump's calls for rate cuts have no impact on the Fed's work. Inflation has significantly decreased. Short-term inflation expectations have risen, while long-term inflation expectations remain aligned with the target. Survey respondents pointed out that tariffs are the main factor driving inflation expectations. The impact of tariffs has been much greater than expected so far.