News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Federal Reserve Payments Conference May Accelerate RWA Tokenization as Ethereum Remains Dominant Onchain2Satoshi-era Bitcoin Wallet Appears Active After Decade as $328M Flows Into Spot Bitcoin ETFs3Ether whales have added 14% more coins since April price lows

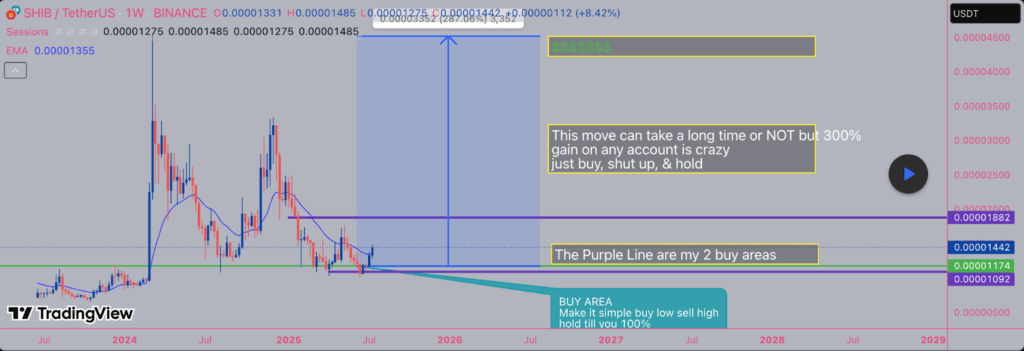

Shiba Inu Gains Strength: 3 Bullish Indicators for SHIB Investors to Watch

CryptoNewsNet·2025/07/19 16:25

Cardano looking to overtake Tron after rallying 10% today

Coinjournal·2025/07/19 16:11

Dogecoin breaks seven-month downtrend with 12.48 % price spike

Coinjournal·2025/07/19 16:11

Ethereum bull run just starting, analyst says as whale scoops $70m ETH

Coinjournal·2025/07/19 16:11

XRP price soars 24% last week: what’s next for the Ripple token?

Coinjournal·2025/07/19 16:10

Bitcoin Maintains Breakout Above $115K, Suggesting Potential Long-Term Target Near $320,000

Coinotag·2025/07/19 16:00

XRP Price Prediction for July 21, 2025: XRP Consolidates Near $3.45 After 50% Weekly Rise

CoinEdition·2025/07/19 16:00

Bitcoin Price Analysis: BTC Unlikely to Revisit ATH Before Testing $111K Support

Cryptopotato·2025/07/19 16:00

Crypto Liquidation: Shocking $270M+ Wiped Out in 24 Hours

BitcoinWorld·2025/07/19 15:50

Axie Infinity Hits Opportunity Buy Zone with Potential for Up to 16,000% Rally

CryptoNewsFlash·2025/07/19 15:40

Flash

- 17:13Greeks.live: The market is currently in a downward trend, and September has historically been a month of weak capital inflows.BlockBeats News, on September 4, Greeks.live macro researcher Adam tweeted, "The market is currently in a clear downward trend. BTC's short- and medium-term IV has risen to 40%, and ETH's short-term IV has surged to 70%. The increase in short-term IV indicates that the market expects higher volatility this week. The decline in crypto-related stocks in the US stock market, especially the MicroStrategy series of stocks, is the trigger for this downturn. Historically, September has always been a month of weaker capital inflows, while the last quarter tends to see more abundant funds. Today's block trading volume of put options is also rising rapidly, with a total transaction amount of $1.17 billion, accounting for 30% of the day's total trading volume, showing that a defensive mindset has become mainstream."

- 17:13pump.fun: Repurchased PUMP tokens worth $12,192,383 in the past weekBlockBeats News, on September 4, pump.fun tweeted that in the past week, a total of $12,192,383 worth of PUMP tokens were purchased, accounting for 98.23% of the total revenue during the same period (from August 28 to September 3). This PUMP purchase has reduced the total circulating supply by 5.363%, an increase of 1.102% compared to last week.

- 17:12Payment public chain Tempo, incubated by Stripe and Paradigm, has launched its private testnetBlockBeats News, September 5, according to official sources, the payment public chain Tempo, incubated by Stripe and Paradigm, has launched its private testnet. Tempo is specifically designed for stablecoins and real-world payments, aiming to provide low fees, support for transferring and paying gas fees with any stablecoin, optional privacy, and over 100,000 TPS. The first batch of partners includes Anthropic, Coupang, Deutsche Bank, DoorDash, Lead Bank, Mercury, Nubank, OpenAI, Revolut, Shopify, Standard Chartered Bank, Visa, and others. Tempo's application scenarios cover global payments and collections, payroll distribution, embedded financial accounts, fast and low-cost cross-border remittances, tokenized deposits with 24/7 settlement, micropayments, agent payments, and more. Tempo is built on Reth and is compatible with EVM.