News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Quick Take The Nasdaq-listed media and entertainment company has increased its digital asset treasury management authorization from $100 million to $250 million. As part of this program, the board approved a new NFT yield strategy and formed strategic partnerships with Dialectic’s Ryan Zurrer and Goff Capital’s Rhydon.

Cardano’s ADA token jumped to a four-month high of $0.92 following founder Charles Hoskinson’s announcement of an independent treasury audit to address fraud allegations involving 318 million ADA tokens.

Strategy added 6,220 Bitcoin for $740 million as price traded at new highs, and coincides with insider share sales from executives.

Nasdaq-listed GameSquare Holdings acquired $30 million worth of Ethereum and expanded its crypto investment authorization to $250 million. The company plans to leverage DeFi protocols for yield generation while building NFT portfolios.

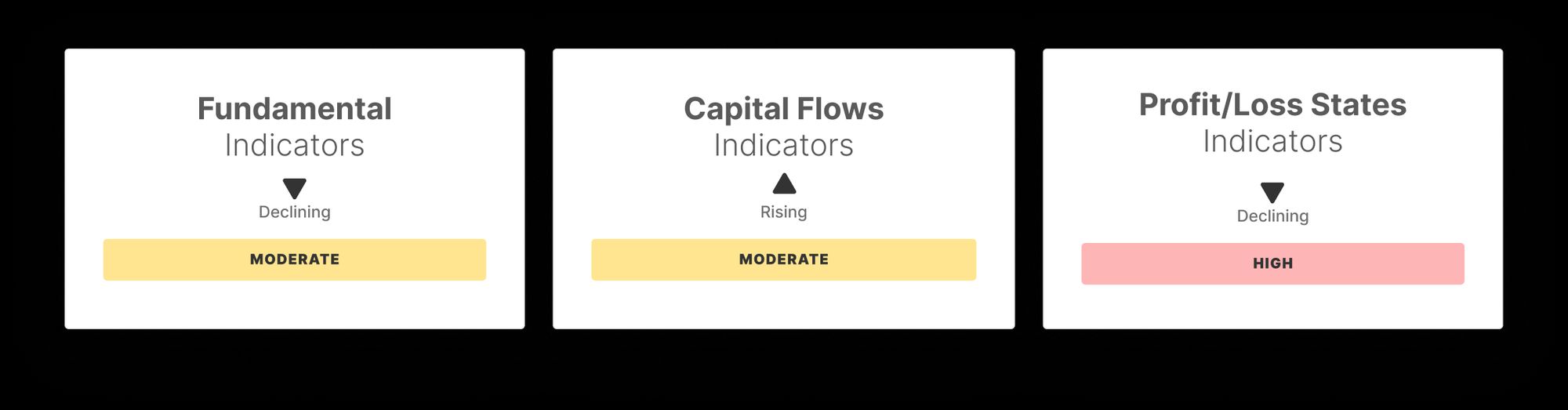

With price pulling back slightly after touching a new all-time high, Bitcoin has hovered around $117k throughout the week. Capital flows remain robust. Profitability metrics have started to cool. Overall, market conditions reflect a healthy yet fragile balance.

- 15:53Market Analysis: US Employment Data Revision Tells the Market Only One ThingJinse Finance reported that Michael Brown, Senior Research Strategist at London-based Pepperstone, stated: "To be honest, I don't think this will really have much impact on the market or the Federal Reserve's policy outlook. (The employment data) is obviously a significant downward revision, which makes you believe that the labor market is stagnating, or at least losing momentum for longer than we previously expected, but that's all you can really see from the data." "These data are quite lagging, so they won't have much impact on the Fed's policymakers. They are still expected to cut rates by 25 basis points next Wednesday, and there will be little impact on the market as well—swap rates have barely changed since the data was released." "If there's any lesson to be learned here, it's that the U.S. Bureau of Labor Statistics (BLS) really needs to improve its data collection methods as soon as possible, since this is the second consecutive year of significant downward benchmark revisions. However, Trump clearly has his own ideas—perhaps not entirely appropriate—about how they should do this."

- 15:52Market Analysis: Revised Employment Data Supports a 25 Basis Point Fed Rate Cut, But Data Does Not Reflect the Full Picture of the EconomyJinse Finance reported that Paul Nolte, Senior Wealth Advisor and Market Strategist at Chicago's Murphy & Sylvest, stated that there is no doubt the Federal Reserve is ready to cut interest rates based on weak employment data—as well as the overall employment situation. This will not prevent the Fed from deciding to cut rates by 25 basis points. The downward revision of the non-farm payroll benchmark data slightly exceeded expectations. We are currently unable to judge the specific situation on a month-to-month basis, nor can we be completely certain in the coming months, but this does indicate that the labor market is indeed weak. However, this contrasts with the weekly initial jobless claims data, which is basically consistent with the levels seen during periods of moderate economic growth. Moreover, our consumer spending situation remains quite good. So I think this is just one piece of the economic puzzle and cannot fully reflect the overall operation of the economy.

- 15:42Analysis: Employment Data Revisions Boost Fed Rate Cut ExpectationsAccording to ChainCatcher, citing Golden Ten Data, Michael James, Managing Director of Equity Trading at Rosenblatt Securities, stated that the revision of U.S. employment data has further fueled expectations of a Federal Reserve rate cut. He pointed out that more information will be obtained from the Consumer Price Index (CPI) on Thursday morning, and the significant decline in labor force growth further indicates that the Federal Reserve will begin its rate-cutting cycle later this month. This expectation has led to an overall better performance in the stock market this morning.