News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump's Remarks Boost Gold Prices; S&P Hits Record High; Storage Stocks Shine in Earnings (January 28, 2026)2Crypto products on CME reached record activity at the end of 20253Bitcoin Achieves Remarkable Stability as a Macro Asset, New Analysis Reveals

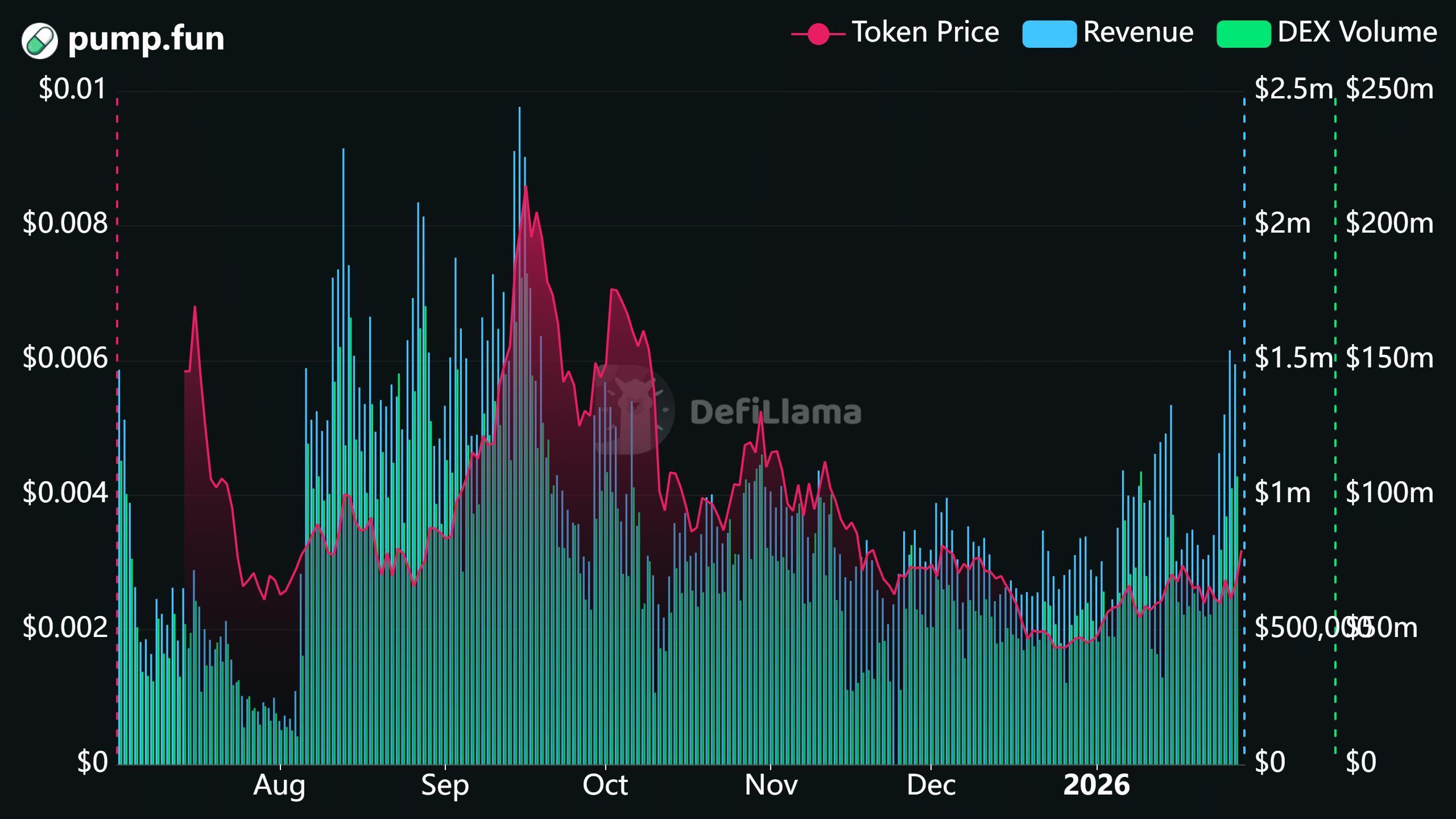

PUMP rallies as Pump.fun usage doubles: Can Solana ride the memecoin wave?

AMBCrypto·2026/01/28 09:03

The Five Most Important Analyst Inquiries from Ally Financial’s Fourth Quarter Earnings Call

101 finance·2026/01/28 09:03

CVB Financial’s Fourth Quarter Earnings Conference: The Five Key Analyst Questions

101 finance·2026/01/28 08:48

The Top 5 Analyst Questions That Stood Out During Fulton Financial’s Q4 Earnings Call

101 finance·2026/01/28 08:48

Dime Community Bancshares Q4 Earnings Call: The Five Most Important Analyst Questions

101 finance·2026/01/28 08:39

5 Essential Analyst Inquiries From BankUnited’s Fourth Quarter Earnings Call

101 finance·2026/01/28 08:39

5 Essential Analyst Inquiries from Pinnacle Financial Partners’ Q4 Earnings Conference Call

101 finance·2026/01/28 08:39

5 Insightful Analyst Inquiries From CACI’s Fourth Quarter Earnings Call

101 finance·2026/01/28 08:36

5 Thought-Provoking Analyst Inquiries During Live Oak Bancshares’s Fourth Quarter Earnings Call

101 finance·2026/01/28 08:36

5 Thought-Provoking Analyst Inquiries From Banner Bank’s Fourth Quarter Earnings Discussion

101 finance·2026/01/28 08:36

Flash

09:08

Stablecoin reserves in US Treasuries surpass those of many countriesCoinWorld News: According to CoinWorld, Wu Blockchain tweeted that Bitcoin OG Adam Back pointed out that stablecoin issuers have become important buyers of U.S. Treasury bonds, holding massive reserves of U.S. Treasuries, even surpassing some major countries. He believes that this convenient, low-friction "new business model" is driving a growing willingness in the market to issue more stablecoins.

09:08

US Stock Movement | Intel continues to rise 4.8% pre-market as reports say Nvidia plans to shift some chip manufacturing to IntelGlonghui, January 28|Intel (INTC.US) continues to rise 4.8% in pre-market trading, quoted at $46.04. According to sources in the supply chain, Nvidia is expected to launch the Feynman architecture platform in 2028 in cooperation with a certain foundry. In this collaboration, Nvidia adopts a strategy of "small volume, low-end, non-core." The GPU core chips will still be manufactured by TSMC, while the I/O chips will partially use the 18A process of the foundry or the 14A process scheduled for mass production in 2028, and will finally undergo advanced packaging by the foundry's EMIB. Based on the proportion of advanced packaging, the foundry accounts for up to about 25%, while TSMC accounts for about 75%.

09:05

QCP: Bitcoin rebounds above the key $88,000 level, options data indicates the market will remain volatile rather than crashBlockBeats News, January 28, QCP released its daily market analysis stating, "Bitcoin has rebounded above the key level of $88,000. Recently, whenever it fell below this level, it often quickly triggered liquidation-led accelerated declines; conversely, a swift recovery tends to pull the price back into the consolidation range. Next, the market will face a series of intensive U.S. macro events: the FOMC rate decision on January 28; the government funding deadline on January 30, which keeps the risk of a shutdown present; and the Senate rescheduling discussions on crypto market structure legislation. The options market clearly reflects this asymmetry. Overall volatility remains controlled, and the term structure maintains a positive spread, so the baseline scenario remains consolidation rather than a sharp crash." In terms of fiscal risk, the key issue is whether Washington can smoothly resolve the January 30 funding problem. If a temporary solution is passed in time, short-term risk premiums are expected to compress, and crypto assets will behave more like pure Beta trades; if there is a brief misstep, the market may fluctuate first but recover after an agreement is reached; if the deadlock persists, it could tighten liquidity and force broader market de-risking. The nearer key event is the Federal Reserve. The baseline expectation remains unchanged rates, with the market focus on when rate cuts will resume. Inflation is still above 2%, while employment is starting to weaken, prompting the committee to remain cautious and data-dependent. With the Fed's independence under scrutiny, it is expected to emphasize its independence and reiterate the stance of 'waiting for more data'; if a hawkish hold occurs, it may trigger a rebound in the dollar and bring short-term volatility to risk assets."

News