News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin’s post-quantum plan BIP-360 gains traction, but will it reverse market sell-off?2Bitcoin holders are being tested as inflation fades: Pompliano3 Bitcoin Price Bottom Not In Yet? Data Signals More Pain Ahead

Resilient Retail Investors Defy Crypto Market Volatility, Buying Bitcoin and Ethereum During Price Drops

Bitcoinworld·2026/02/16 01:36

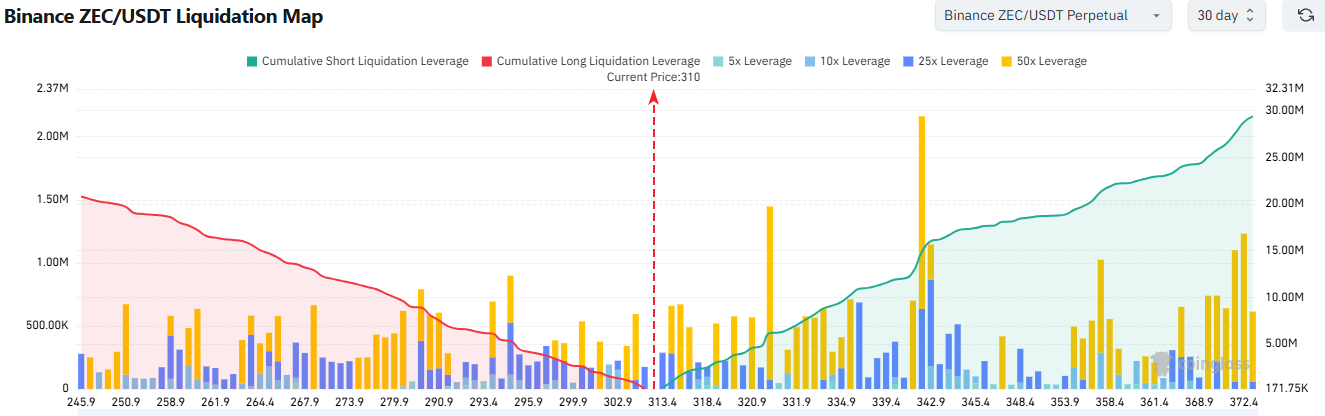

ZCash short-term momentum solidifies: Here’s what you can expect this week

AMBCrypto·2026/02/16 01:03

Gold Slips as Investors Take Profits After Surpassing $5,000 per Ounce

101 finance·2026/02/16 01:00

Roundhill files 2028 election ETFs

Grafa·2026/02/16 00:24

Australian Dollar Forecast: AUD/USD Surge Faces Potential Volatility Near Highs

101 finance·2026/02/16 00:15

Buterin urges prediction market shift

Grafa·2026/02/16 00:09

Goldman Sachs: Current Yen Rally Is "Too Strong, Too Fast" Due to BOJ Policy Risks

新浪财经·2026/02/15 23:58

Solana Tops $80 Amid Breakout Risk Debate

Grafa·2026/02/15 23:54

Bitcoin and Ether ETFs Log Modest Friday Inflows

Grafa·2026/02/15 23:33

A consortium led by Macquarie agrees to acquire Qube Holdings for $8.3 billion

新浪财经·2026/02/15 23:19

Flash

01:33

A whale deposited 1 million USDC on the HyperLiquid platform to go long on ETH.PANews reported on February 16 that, according to OnchainLens monitoring, a whale deposited USDC worth $1 million on the HyperLiquid platform and opened a long position in ETH (20x leverage), while still holding a long position in SOL (20x leverage). This whale also increased holdings in the following tokens: 20,000 SOL (worth $1.7 million) 8.5 million Fartcoin (worth $1.69 million) 30 million Mon (worth $717,000) 6.73 million XPL (worth $651,000) This whale has suffered a total loss of over $11.877 million.

01:30

The cryptocurrency industry actively intervenes in the US midterm elections with substantial funds.According to ChainCatcher, citing The Hill, after achieving several key victories and accumulating massive funds in 2024, the cryptocurrency industry is ramping up its spending in preparation for the upcoming U.S. midterm elections.

01:28

Foreign Media: Cryptocurrency Industry Actively Involved in US Midterm Elections with Strong Financial BackingBlockBeats News, February 16th, according to The Hill, the cryptocurrency industry, after achieving several key victories in 2024 and accumulating a huge amount of funds, is increasing its spending efforts to prepare for the upcoming U.S. midterm elections.

The industry's primary super PAC network, Fairshake, had over $193 million in cash on hand in early 2026 and has announced several targets for this election cycle: including supporting Congressman Barry Moore (Republican-Alabama) in the Alabama Senate race and pushing for the removal of Congressman Al Green (Democrat-Texas) in the House election.

After heavily investing in the last U.S. election and claiming victory in at least two highly watched races, this has brought some early results for the industry in Congress and elevated the position of the crypto industry in Washington.

The crypto industry's impact was most significant in 2024 when it poured in tens of millions of dollars, intervening in multiple primaries and fiercely contested elections. According to the 2024 campaign finance filings, Fairshake's super PAC network, which includes three affiliated groups, spent nearly $180 million in the last cycle.

News