News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump's Remarks Boost Gold Prices; S&P Hits Record High; Storage Stocks Shine in Earnings (January 28, 2026)2Crypto products on CME reached record activity at the end of 20253Bitcoin Achieves Remarkable Stability as a Macro Asset, New Analysis Reveals

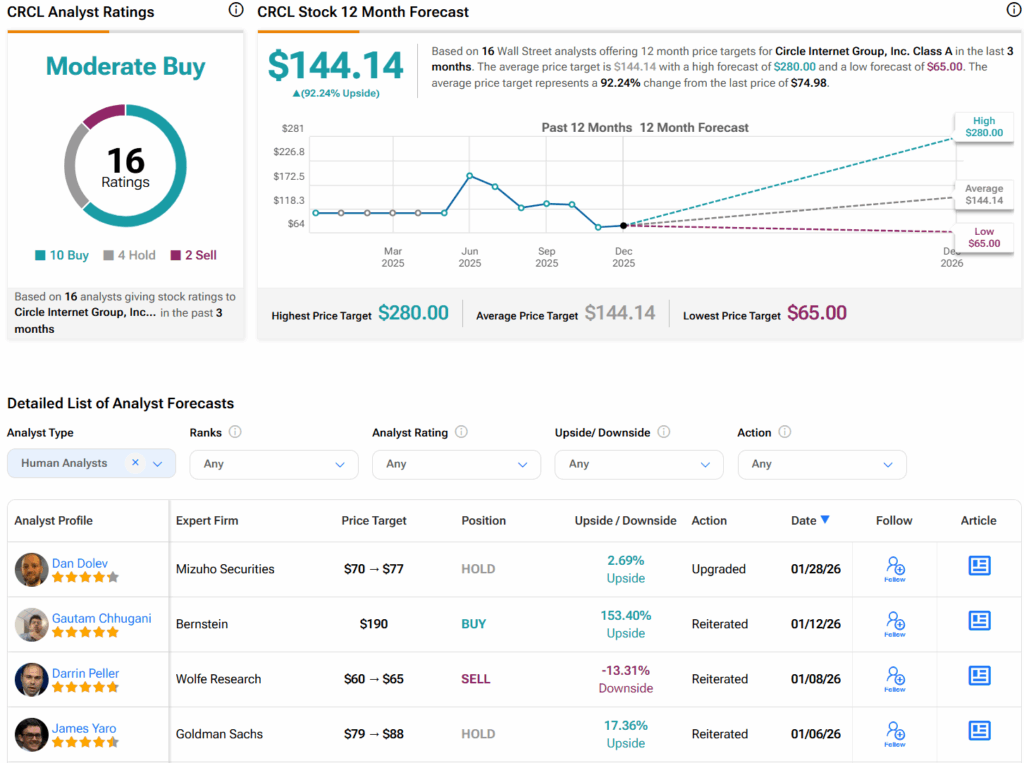

Circle Stock (CRCL) Surges as Polymarket Activity Prompts Analyst Upgrade

Tipranks·2026/01/28 19:39

Bitcoin crash is among ‘black swans’ feared in Russia

Cointelegraph·2026/01/28 19:36

South Korea’s financial regulator supports ownership caps for digital asset exchanges

Cointelegraph·2026/01/28 19:15

Jennifer Garner’s Once Upon a Farm restarts its IPO preparations

101 finance·2026/01/28 19:12

Federal Reserve issues FOMC statement

·2026/01/28 19:00

AI Stocks Gain Momentum as Nasdaq Approaches Record Highs Before Major Tech Earnings

101 finance·2026/01/28 18:48

Peterson Calls February " The Real Uptober " For Crypto

Cointribune·2026/01/28 18:42

Top Altcoins Gain Strength as Chainlink and Uniswap Signal a Potential Breakout

Coinpedia·2026/01/28 18:30

South Korea Nears Landmark Crypto Regulation With Digital Asset Basic Act

Coinpedia·2026/01/28 18:30

Flash

19:46

PIPPIN plummeted 58% in 24 hours: However, experienced meme coin traders are now turning their attention to Maxi DogeReported by Bijie Network: The AI-themed meme token PIPPIN, created by BabyAGI developer Yohei Nakajima, surged 60% in a single day to reach $0.4919, with its market capitalization soaring to approximately $489 millions. PIPPIN was originally an experimental project for ChatGPT-4o and has now evolved into the economic layer of a decentralized AI assistant framework. Its recent surge highlights the powerful potential of combining AI and meme technologies, and may boost interest in simpler meme tokens such as the presale token Maxi Doge, which has already raised $4.53 millions.

19:44

Institution: The latest FOMC statement may signal that the Federal Reserve will refocus on inflationBlockBeats News, January 29, the Federal Reserve kept interest rates unchanged as expected and stated that its March decision will depend on upcoming data. Sid Vaidya, a wealth management analyst at TD Securities, said that the statement acknowledged strong GDP growth and a stable unemployment rate, raising questions about how much emphasis the Federal Reserve will place on still-elevated inflation. A recent series of rate cuts has supported employment. Therefore, Sid Vaidya suspects that the latest statement may signal that the Federal Reserve will refocus on inflation. (Golden Ten Data)

19:42

Juan Perez: The Federal Reserve's decision eases dollar pressure, but policy path remains unpredictableAccording to Golden Ten Data, Juan Perez, Head of Trading at Monex USA in Washington, stated that in the context of prevailing market uncertainty, it is reasonable for the Federal Reserve to remain cautious and refrain from adjusting interest rates for now. There is still a lack of consensus among committee members, so this decision to some extent helps ease the pressure the US dollar has been under since January 20. Perez believes that the Federal Reserve's policy path will remain quite unpredictable.

News