News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Spot Gold & Silver Continue to Drop, Bitcoin Crashes; Amazon’s $200 B Capital Expenditure Raises Concerns; U.S. Job Openings Fall to 2020 Lows — Feb 6, 2026 (English Translation)2Weekend Trading Playbook: High-Impact Macro Events & Earnings for Feb 9-15, 2026 – Tech & Crypto Volatility Plays3 Is the “Perfect Storm” Here? Liquidations Explode as Bitcoin Bleeds Below $70K & DXY Rises

Elon Musk says it's not impossible for Tesla's market value to reach $100 trillion

新浪财经·2026/02/09 00:04

Arthur Hayes Bet Challenges Kyle Samani with $100K HYPE Price Wager in Explosive Crypto Feud

Bitcoinworld·2026/02/08 23:06

Cardano loses top-10 spot as price hits 3-year low – What should traders do next?

AMBCrypto·2026/02/08 23:03

ZRO Breaks Above $1.72 Resistance as Analyst Spots Strong Buy Signal That Positions LayerZero for 47% Spike

BlockchainReporter·2026/02/08 23:00

Australian Dollar Forecast: Interest Rates Drive AUD/USD, Options Indicate Potential Volatility

101 finance·2026/02/08 22:54

Warsh's Push for a Fed-Treasury Agreement Sparks Discussion in the $30 Trillion Bond Market

101 finance·2026/02/08 21:39

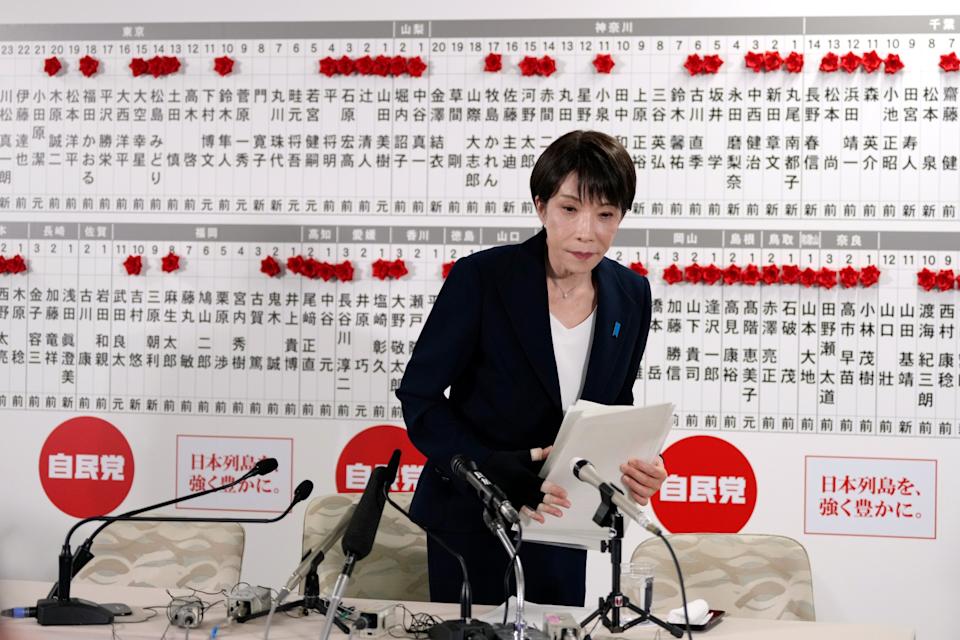

Yen Drops as Japan’s Takaichi Set for Overwhelming Election Victory

101 finance·2026/02/08 21:21

Flash

00:24

Vitalik: USDC Yield is not DeFi, Algorithmic Stablecoins are the Real DeFiBlockBeats News, February 9th, Vitalik Buterin posted on the X platform, stating, "USDC savings interest does not count as DeFi. I believe that algorithmic stablecoins are the true DeFi. If we have a high-quality algorithmic stablecoin backed by ETH, then even if 99% of the liquidity is actually provided by CDP holders, as long as you can transfer the counterparty risk on the dollar side to the liquidity provider, this in itself is a significant feature.

Even if an algorithmic stablecoin is backed by RWAs, as long as it is overcollateralized, and the collateral assets are sufficiently diversified—so that even if any single RWA has issues, the overall collateral remains fully backed—compared to a standard structure, it is still a meaningful improvement in terms of the risk characteristics borne by holders.

I believe that this type of design is the direction we should strive for. Building on this, the next step could gradually move away from the dollar as the unit of account and towards a more universal, more diversified index-based pricing system. Of course, the current practice of 'depositing USDC into Aave to earn interest' does not fit into any of the categories I mentioned above."

00:04

Vitalik: DeFi Should Go Beyond USDC Yields, Algorithmic Stablecoins Need Diversified DevelopmentEthereum founder Vitalik Buterin recently posted on social media, discussing the core value of DeFi and the development direction of algorithmic stablecoins. He believes that DeFi should provide financial services while maintaining asset self-custody, rather than relying solely on the USDC yield model. Vitalik proposed two development paths for algorithmic stablecoins: algorithmic stablecoins backed by ETH can disperse risk through market mechanisms; stablecoins based on real-world assets need to achieve over-collateralization and asset diversification to reduce the risk of single assets.

00:03

Sanae Takaichi seizes control of the House of Representatives, market focuses on fiscal policy designIn the early Asian session on February 9, the yen continued its recent decline. Shoki Omori, Chief Rates and FX Strategist at Mizuho Securities Tokyo, stated that the overwhelming victory of the Liberal Democratic Party has eliminated political uncertainty and strengthened policy implementation. The market focus has now shifted to the design and communication of fiscal policy. The risk of fiscal expansion before the general election has already been priced in by the market, and the key issue is whether these risks will be reinforced or gradually fade away.

News