News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Gold and Silver Rebound with Gold Back Above 5000; Nikkei 225 Hits New Historical High; US-India Reach Interim Trade Framework (February 9, 2026)2Why Alphabet's Free Cash Flow May Remain Resilient Even as the Market Worries - Strategies for Investing in GOOGL3Bitcoin Price Prediction 2026-2030: Unveiling the Critical Path for BTC’s Future Value

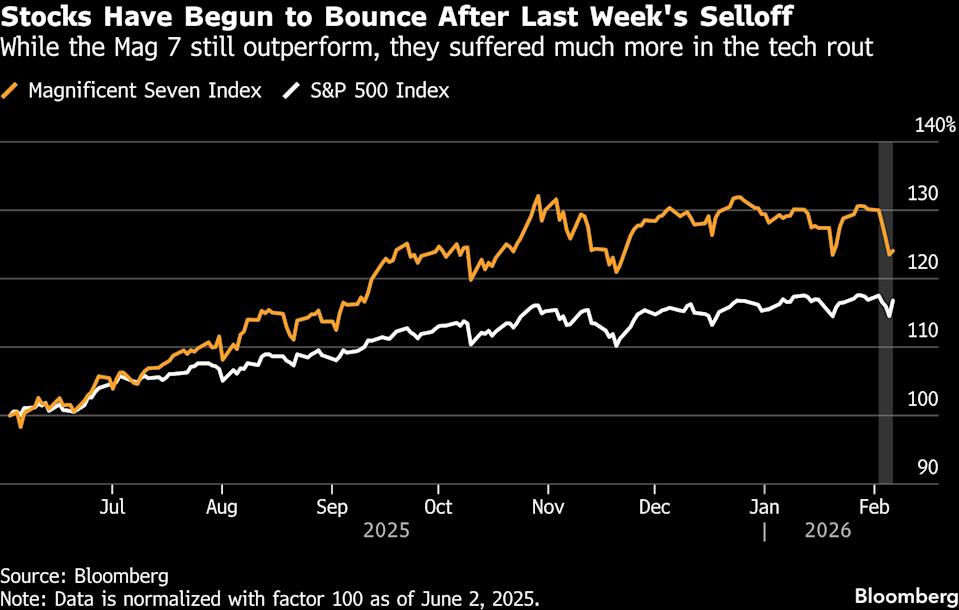

Morgan Stanley’s Wilson Believes AI Could Drive Tech Stocks Even Higher

101 finance·2026/02/09 12:03

Waters: Fourth Quarter Financial Results Overview

101 finance·2026/02/09 12:03

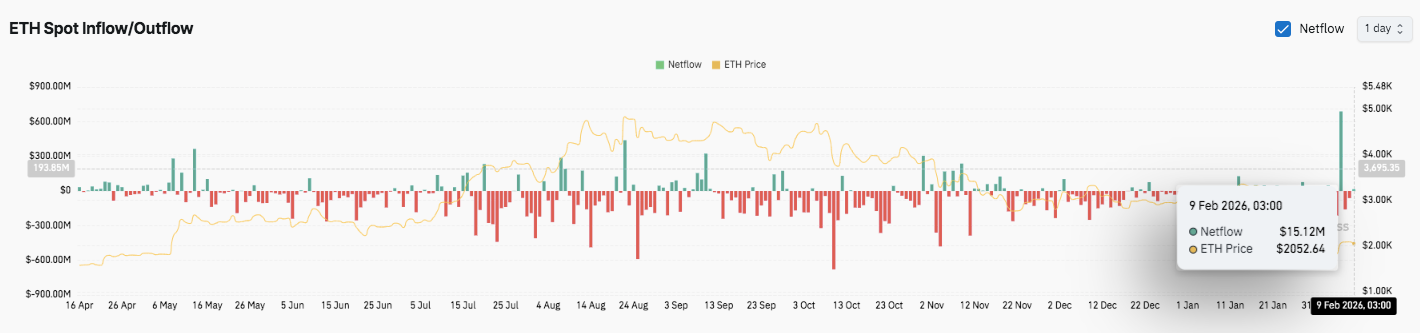

Ethereum Price Prediction: ETH Consolidates After Sell-Off, But Bears Still Control the Trend

CoinEdition·2026/02/09 12:03

Hyperliquid Stays Strong Following Ripple Partnership, Even as Market Optimism Fades

101 finance·2026/02/09 11:54

Curbline: Q4 Financial Results Overview

101 finance·2026/02/09 11:51

Dynatrace: Fiscal Third Quarter Earnings Overview

101 finance·2026/02/09 11:42

Ethereum Ecosystem Security Assessment Tool Developed

Coinspaidmedia·2026/02/09 11:42

FedEx-supported investors reach agreement to acquire Polish parcel locker company InPost

101 finance·2026/02/09 11:36

PIPPIN Price Soars 50% to $0.28: Can the Bull Run Break Higher?

Cryptotale·2026/02/09 11:30

Bitcoin: Glassnode Data Reveals a Widespread Return to Accumulation

Cointribune·2026/02/09 11:15

Flash

12:10

Metalpha launches Bitcoin allocation plan, with up to 20% of annual net profit used to purchase BTCAccording to Odaily, Metalpha Technology Holding Limited, a Nasdaq-listed provider of blockchain and trading technology solutions, announced that its board of directors has approved a bitcoin purchase plan, allocating up to 20% of the company's annual net profit for bitcoin purchases. It is reported that the initial allocation of $3.2 million has been made, and a $1 million BTC purchase was completed on February 9.

12:08

Deutsche Bank raises Eli Lilly's target price to $1,285Glonghui, February 9th|Deutsche Bank: Raised Eli Lilly (LLY.US) target price from $1,200 to $1,285.

12:00

A certain exchange's Ventures: Market operates under pressure amid increasing macro uncertainty, with both defensive capital strategies and structural opportunities coexisting.PANews, February 9 – According to the latest crypto weekly report released by a certain exchange, since the beginning of February, global macro uncertainty has continued to intensify. Divergences remain regarding expectations for the rate cut path, the pace of balance sheet reduction, and the coordination of fiscal and monetary policies. Several key macroeconomic data will be released intensively this week, becoming important variables for short-term market pricing. Against this backdrop, the overall crypto market has been under pressure, with bitcoin and ethereum dropping 8.6% and 7.9% respectively over the week. Related ETFs have seen historic net outflows, and market sentiment remains in the "extreme fear" range. Meanwhile, gold and risk assets have fluctuated in tandem, reflecting continued caution in overall financial market risk appetite. At the industry level, structural progress continues. Polymarket and Circle announced a partnership, migrating their settlement system to native USDC, further strengthening the application of compliant stablecoins in on-chain scenarios. In terms of investment and financing, a total of 12 financing deals were completed last week, with funds mainly flowing into the infrastructure sector. Among them, Tether made a strategic investment of $100 million in Anchorage Digital, further expanding its compliant crypto infrastructure layout; TRM Labs completed a $70 million financing round, continuing to expand its crypto intelligence and compliance capabilities. Overall, short-term market volatility pressures persist, but capital and industry development are gradually focusing on defensive attributes and long-term structural opportunities.

News