Crypto Privacy Era Concludes as IRS Integrates into International Tax System

- The White House proposes IRS access to offshore crypto transactions via OECD's CARF framework to combat tax evasion and align with global standards. - CARF, supported by 72 countries including major economies, will enable cross-border data sharing while exempting DeFi transactions from new reporting rules. - U.S. crypto exchanges will report detailed transactions to IRS from 2026, marking a shift toward transparency as markets react with price volatility. - Critics raise privacy concerns over expanded IR

The White House is moving forward with a plan that would allow the Internal Revenue Service (IRS) to monitor cryptocurrency transactions by U.S. taxpayers on overseas platforms. This initiative is intended to bring the U.S. in line with international tax practices and combat global tax avoidance. The proposal, which was sent to the Office of Information and Regulatory Affairs last week,

CARF, which is scheduled for worldwide rollout in 2027,

Experts anticipate that CARF will reshape the global crypto landscape by boosting transparency and reducing opportunities for tax evasion.

Within the U.S., the IRS is also gearing up for tighter regulations.

The proposal is under review as the IRS faces leadership challenges. President Donald Trump recently rescinded his nomination of Donald Korb, an experienced tax lawyer, for the position of IRS chief counsel, raising concerns about the agency’s readiness to handle complex regulatory changes. Nonetheless,

The changing regulatory landscape has already influenced the value of leading cryptocurrencies, with

Opponents warn that expanding IRS oversight could threaten user privacy, particularly for those using self-custody wallets outside the traditional financial system. Supporters, however, argue that these steps are necessary to stop tax evasion in a sector where assets can be moved instantly across borders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: In a Bold Move Against the IMF, El Salvador Ramps Up Bitcoin Purchases to Assert Independence

- El Salvador's government bought 1,098.19 BTC ($100M) amid market downturn, boosting total holdings to 7,474.37 BTC ($688M) as part of its "buy the dip" strategy. - President Bukele defies IMF criticism over public-sector Bitcoin purchases, emphasizing financial sovereignty through blockchain-based accumulation. - The country's aggressive accumulation has positioned it as the fifth-largest Bitcoin holder globally, inspiring other nations like the Czech Republic to explore crypto adoption. - Despite being

Bitcoin News Update: Short-Term Investors Face Losses as Bitcoin Falls Under $95K

- Bitcoin fell below $95,000 on Nov 15, erasing 23% from its October peak amid extreme fear signaled by a 10-point Fear & Greed Index. - 2.8 million BTC held under 155 days are underwater, with STHs driving 90% of recent sell volume as SOPR dipped below 1 repeatedly. - Institutional outflows ($870M from US ETFs) and Fed policy uncertainty (53.6% Dec rate cut chance) intensified liquidations exceeding $600M in hours. - Analysts split between bearish corrections to $85,000 if $92,000 support breaks or mid-cy

ALGO Gains 1.64% Following Stock Option Awards and Fluctuating Market Conditions

- Aligos grants 23,600 stock options to new hires under 2024 Inducement Plan, vesting over four years to retain talent. - ALGO shares rose 1.64% short-term but fell 53.66% annually amid market volatility and key economic data releases on Nov 19. - Eshallgo expands globally with U.S. subsidiary, hardware-software investments, and shelf registration to strengthen operations. - Upcoming FOMC minutes, oil inventories, and CPI data will shape monetary policy expectations and investor behavior. - Insider transac

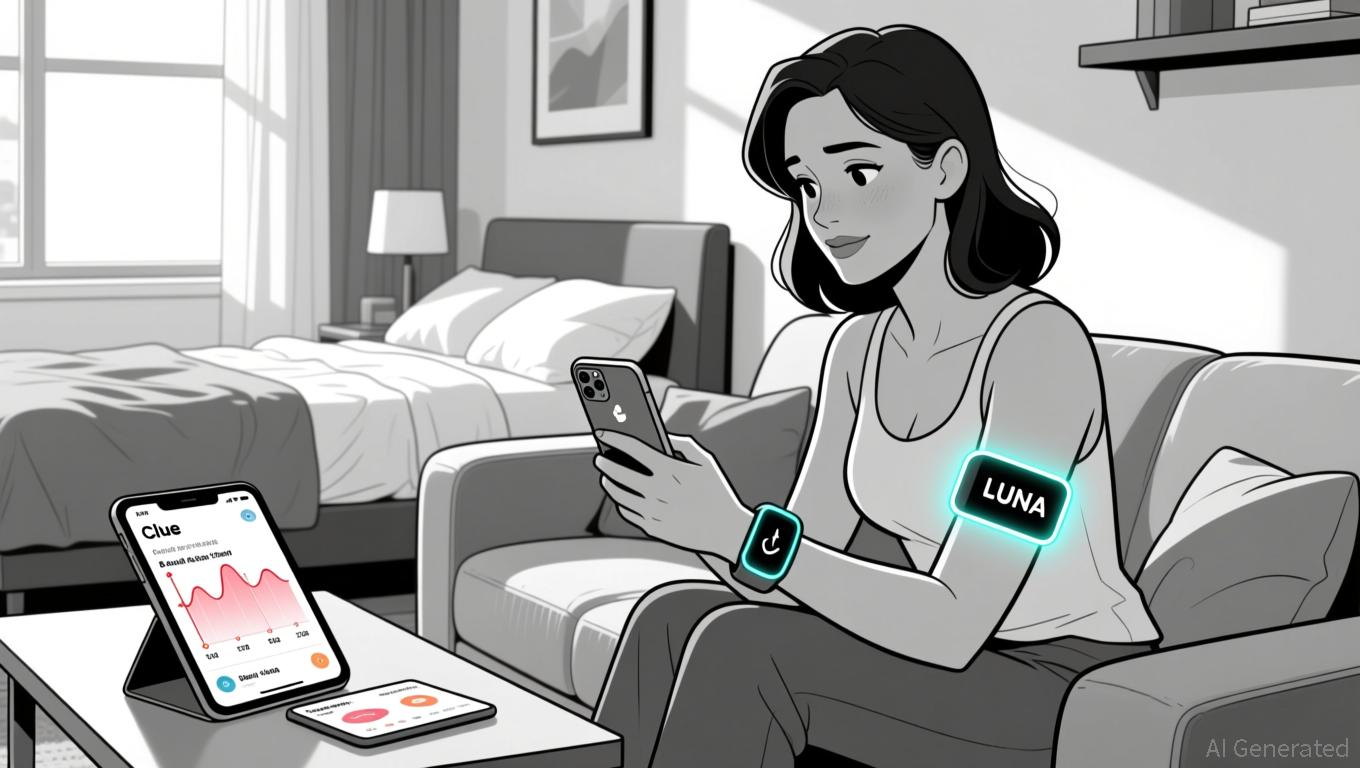

LUNA Value Remains Steady as Wearable Health Integration Broadens

- LUNA maintains stable price at $0.0774 despite 81.5% annual decline, driven by health-tech partnerships rather than crypto market shifts. - Expanded integration with Clue enables LUNA wearables to sync sleep/temperature data with 100M+ users for menstrual cycle tracking insights. - Strategic partnerships with leading wearables (Fitbit, Huawei) and exclusive discounts aim to boost adoption of cycle-aware health tracking devices. - 60%+ user demand for health wearables highlights growing market opportunity