Pi Coin Price Rises 10% As Capital Inflows Jump to 6-Week High

Pi Coin rallies 10% as inflows spike sharply, RSI rises, and investors push the asset toward a potential breakout above key support.

Pi Coin is gaining strong traction after a sharp 10% price increase that lifted the token to a weekly high. The recent rise reflects renewed investor confidence and improving market conditions.

Strengthening demand and accelerating inflows continue to support Pi Coin’s upward movement, signaling momentum that could extend in the near term.

Pi Coin Is Picking Up Capital

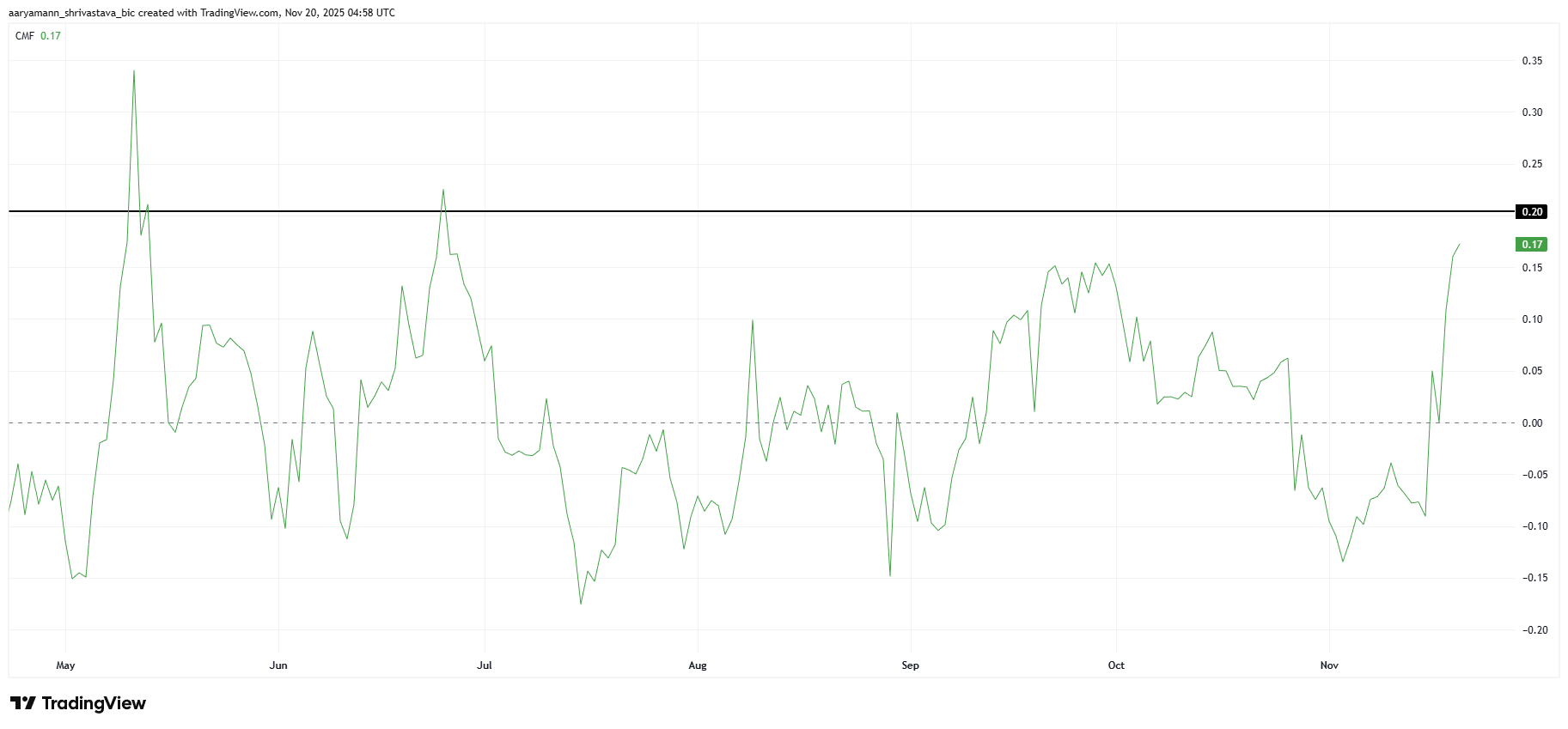

Market sentiment has strengthened notably, with the Chaikin Money Flow showing a sharp rise over the past few days. CMF measures capital flows, and a move into positive territory signals increasing inflows. Pi Coin’s CMF is climbing quickly, suggesting that investors are actively adding liquidity to the asset.

This uptick reflects growing confidence in Pi Coin’s short-term outlook. As inflows increase, the buying pressure strengthens. Investors appear motivated by improving conditions and are positioning themselves for continued gains.

Pi Coin CMF. Source:

TradingView

Pi Coin CMF. Source:

TradingView

Macro momentum indicators are also aligning with Pi Coin’s bullish trend. The Relative Strength Index is observing a steady uptick, showing rising demand and stronger upward momentum. A rising RSI often suggests that buyers are gaining control and driving sustained appreciation.

This strengthening momentum is crucial for supporting ongoing growth. As broader market sentiment improves, Pi Coin may continue benefiting from increased risk appetite across altcoins.

Pi Coin RSI. Source:

TradingView

Pi Coin RSI. Source:

TradingView

PI Price Could See Continued Rise

Pi Coin trades at $0.250 after rising 9.5% in the past 24 hours. The altcoin is preparing to flip $0.246 into a confirmed support level. Holding this range will be essential for maintaining upward momentum and preventing short-term pullbacks.

If Pi Coin secures the support, it could rise toward $0.260 and higher, recovering losses from late October. Such movement may attract new investors looking for momentum-driven opportunities, further sustaining the ongoing rally. Strengthening fundamentals and improving sentiment add to the bullish outlook.

Pi Coin Price Analysis. Source:

TradingView

Pi Coin Price Analysis. Source:

TradingView

However, if Pi Coin faces selling pressure, the price could slip below $0.246 and weaken current support. A decline may push the altcoin toward $0.234 or even $0.224, signaling a deeper retracement. This scenario would invalidate the bullish thesis and reflect fading confidence among traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Emergence of ICP Caffeine AI: A Fresh Driving Force for Blockchain Expansion Powered by AI?

- DFINITY Foundation launched ICP Caffeine AI in November 2025, claiming to reduce AI inference costs by 20–40% through on-chain execution. - Institutional partnerships and a deflationary token model drove a 385% ICP price surge in Q4 2025, but dApp activity fell 22.4%, signaling engagement challenges. - The platform’s hybrid cloud partnerships and chain-of-chains design aim to bridge DeFi and traditional finance, yet regulatory scrutiny and C3.ai’s financial instability pose risks. - Experts remain divide

Trump Signs "Genesis Mission" Order to Boost AI Innovation in the United States

France : Larchevêque Unveils The Bitcoin Society

Nasdaq Biotech’s $212M RAIN Funding Sparks 130% Jump

- Enlivex Therapeutics invests $212M in RAIN tokens via a Nasdaq-listed biotech's first prediction market-focused strategy, driving a 130% price surge. - The move coincides with former Italian PM Matteo Renzi joining Enlivex's board, sparking speculation about institutional crypto adoption and political influence. - RAIN broke key technical resistance levels, reaching $0.006974 and $1.7B market cap, but analysts warn of potential reversals if $0.00800 resistance fails. - Despite Enlivex's 23% YTD stock dec