U.S. Crypto Companies Caution: Ambiguous Regulations Jeopardize Leadership in Innovation

- Over 65 crypto firms, including Ethereum and Solana , urge U.S. regulators to establish unified rules for taxation, innovation, and developer protections to reduce sector uncertainty. - Industry highlights IRS's 2023 staking tax policy as unfair, seeking a $600 de minimis threshold and clearer guidelines to avoid penalizing unrealized gains. - DeFi advocates demand legal safeguards for developers after cases like Tornado Cash, urging SEC/CFTC to issue exemptions and DOJ to avoid prosecuting decentralized

More than 65 companies and groups in the cryptocurrency industry have addressed a letter to President Donald Trump, asking the U.S. government to provide clearer rules regarding taxation, financial innovation, and protections for developers in the crypto field. This letter, endorsed by leading entities such as

Taxation was identified as a major concern in the letter. Industry leaders pointed out that the IRS’s 2023 policy, which taxes staking rewards when received rather than when sold, could result in taxes on gains that haven’t been realized. Senator Todd Young (R-IN) has raised similar issues,

The coalition also pressed for more transparent rules to support decentralized finance (DeFi) and token development, warning that unclear regulations leave both developers and users vulnerable to legal challenges. The letter calls on the SEC and CFTC to grant exemptions for DeFi protocols and urges the DOJ not to prosecute developers for creating decentralized applications. This request comes after the Tornado Cash case, in which developer Roman Storm was found guilty of running an unlicensed money transmission business. Although the DOJ recently stated that “writing code is not a crime,” the industry is seeking stronger assurances to protect innovation from regulatory overreach.

The letter also emphasizes the importance of coordinated efforts among federal agencies. The President’s Working Group Report on Digital Assets,

Recent nominations, such as Michael Selig’s selection to head the CFTC,

The crypto sector’s demand for regulatory clarity highlights the ongoing debate between fostering innovation and ensuring oversight. As the U.S. aspires to become the “crypto capital of the world,”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Growing Institutional Interest in ETH Amid Rising Worries Over Decentralization

- Ethereum’s institutional adoption accelerates as Tether , BlackRock , and SGX expand crypto infrastructure and ETF strategies. - Vitalik Buterin warns of decentralization risks from concentrated ETH ownership and potential quantum computing threats by 2028. - SGX launches Bitcoin/Ethereum futures to boost institutional liquidity, while ETF outflows and bearish indicators signal market weakness.

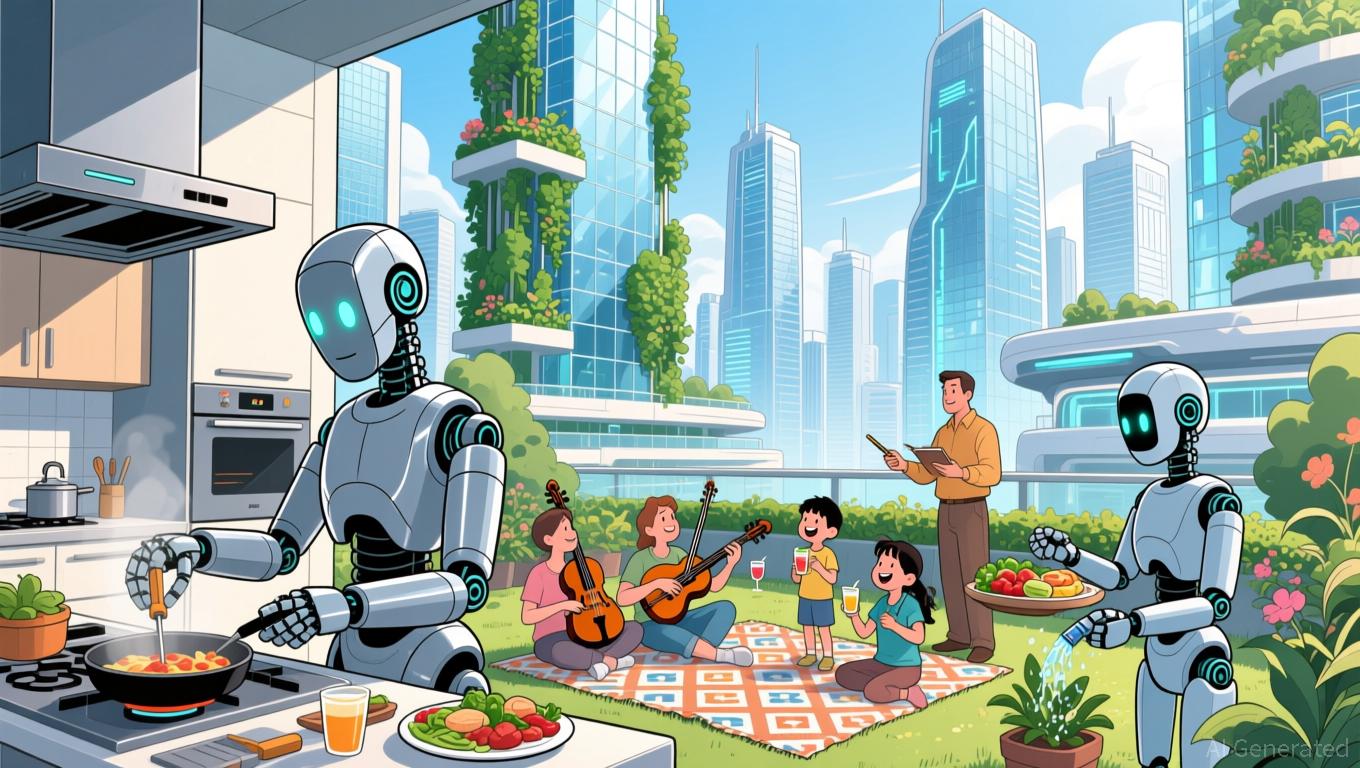

Musk's Vision of a Future Without Mandatory Work Ignites Discussions on the Practicality of AI and Social Disparities

- Elon Musk predicts work will become optional in 10-20 years as AI/robotics render traditional labor obsolete, comparing future employment to leisure activities. - Tesla aims for 80% of its value to derive from Optimus robots, while economists question scalability challenges and decreasing returns in robotics adoption. - AI-driven sectors like Energy Management Systems are projected to grow rapidly, but face high costs and integration barriers for small businesses. - Critics warn Musk's vision risks exace

Federal Reserve Decisions and Their Impact on Solana (SOL)

- Fed's 2025 rate cuts and QE pivot drive institutional capital into Solana's blockchain ecosystem, boosting staking ETFs to $550M in assets. - Regulatory alignment via GENIUS Act and Solana's U.S.-backed stablecoin enhance institutional trust in crypto compliance frameworks. - Fed policy uncertainty triggers short-term volatility (14% Solana price drop), yet 21Shares' $100M ETF inflow signals enduring institutional confidence. - Projected 2026 QE transition could amplify liquidity for Solana's DeFi infras

ICP Caffeine AI's Latest Advancement and Its Impact on the Web3 Industry Driven by Artificial Intelligence

- ICP Caffeine AI, launched by DFINITY in 2025, enables no-code dApp development via natural language prompts on the Internet Computer blockchain. - Its "chain-of-chains" architecture processes AI tasks on-chain, positioning ICP as a first "AI-native blockchain" with hybrid cloud scalability. - A reverse-gas tokenomics model drove 56% ICP price growth and $237B TVL, but dApp activity dropped 22.4% amid SEC regulatory pressures. - Strategic Chain Fusion tech enables Bitcoin/Ethereum interoperability, attrac