Hain Celestial (HAIN) Q4 Results Preview: Key Points to Watch

Hain Celestial Set to Release Earnings Report

Hain Celestial (NASDAQ:HAIN), a company specializing in natural foods, is scheduled to announce its latest earnings before the market opens this Monday. Here’s a preview of what investors should keep an eye on.

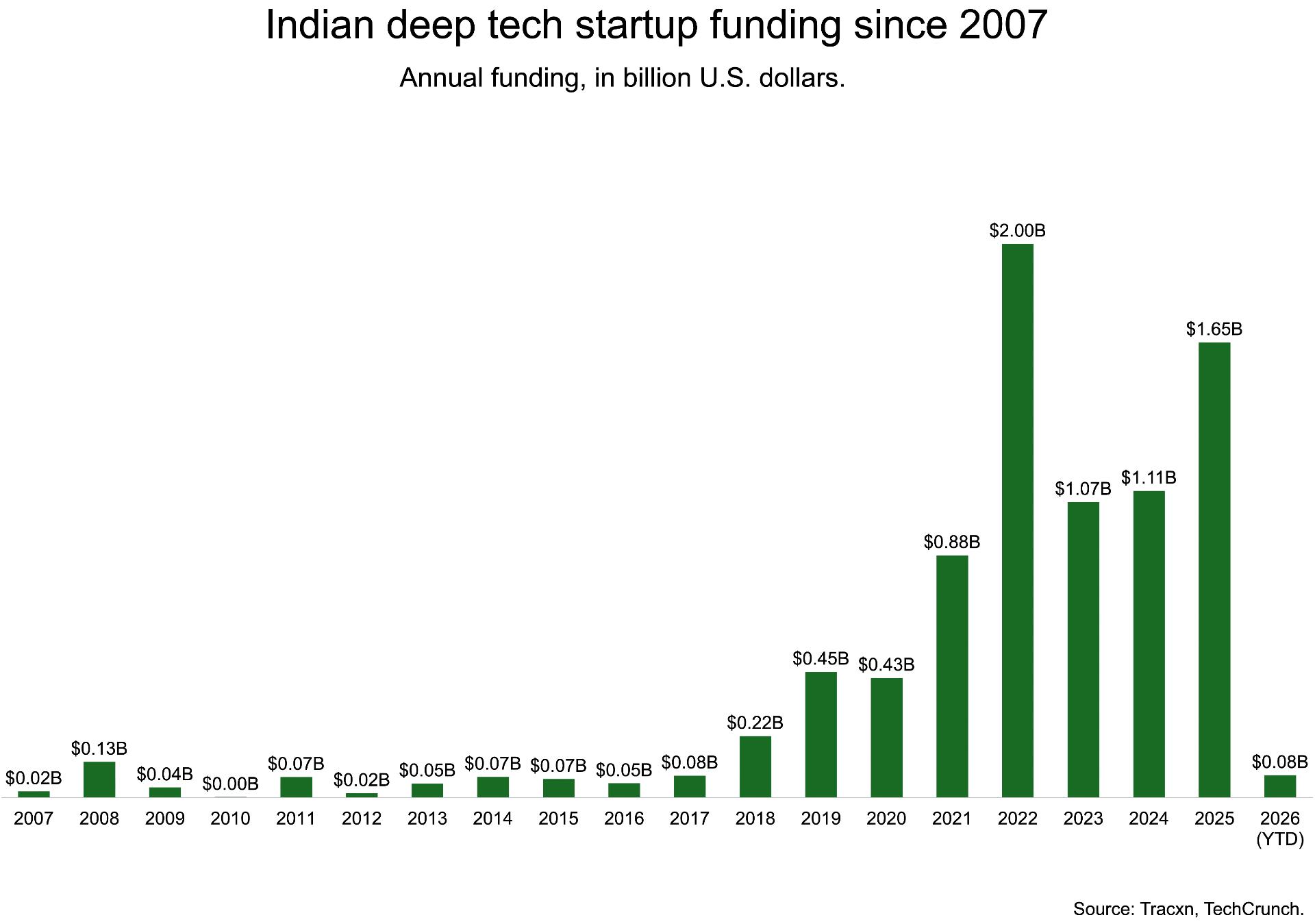

In the previous quarter, Hain Celestial surpassed revenue forecasts by 2.1%, posting $367.9 million in sales—a 6.8% decrease compared to the same period last year. The results were mixed: while the company exceeded expectations for adjusted operating income, it fell short on earnings per share.

For the upcoming quarter, analysts predict that Hain Celestial’s revenue will decline by 7.1% year over year to $382.4 million. This would be an improvement over the 9.4% drop reported in the same quarter last year.

Analyst Expectations and Recent Performance

Over the past month, most analysts have maintained their forecasts for Hain Celestial, indicating steady expectations as the earnings date approaches. Notably, the company has missed revenue projections from Wall Street six times in the last two years.

Industry Peers: Recent Results

Several competitors in the shelf-stable food sector have already released their fourth-quarter numbers, offering some insight into the industry’s performance. Hershey reported a 7% increase in revenue year over year, beating estimates by 3.8%, while BellRing Brands’ revenue remained flat but still surpassed expectations by 6.7%. Following these announcements, Hershey’s stock rose by 12.5%, whereas BellRing Brands saw a 13.4% decline.

Market Sentiment and Share Price Trends

The shelf-stable food sector has seen a positive trend recently, with average share prices climbing 8% over the past month. Hain Celestial’s stock has gained 5.1% during this period. Heading into earnings, the average analyst price target for Hain Celestial stands at $2.04, compared to its current price of $1.25.

Spotlight: Share Buybacks and Value Opportunities

When a company has excess cash, repurchasing its own shares can be a smart move—provided the valuation is attractive. We’ve identified a low-priced stock that is generating strong free cash flow and actively buying back shares.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

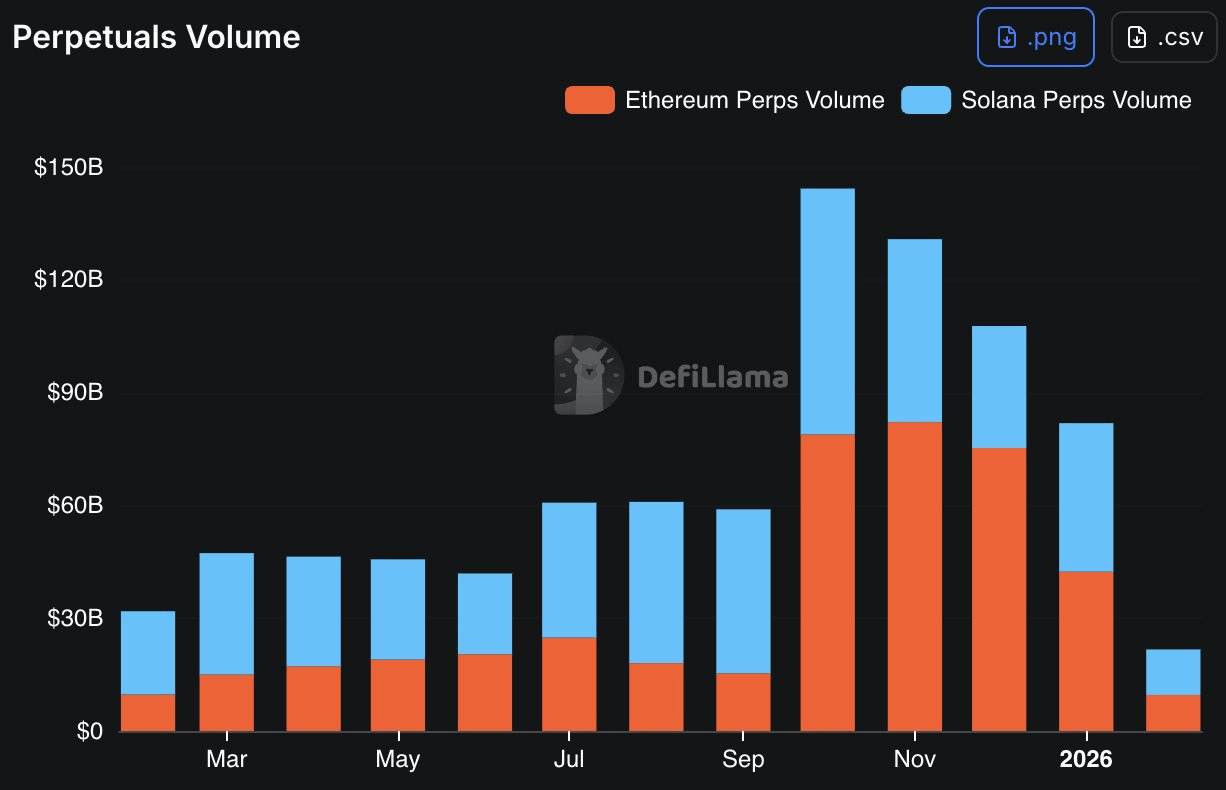

Solana’s quiet takeover – Can SOL profit from the FUD around Ethereum?

COTI Earn Brings More Yield to $ADA and $USDT Holders via Carbon DeFi

Market Loaded with Shorts as Long Bets Decline

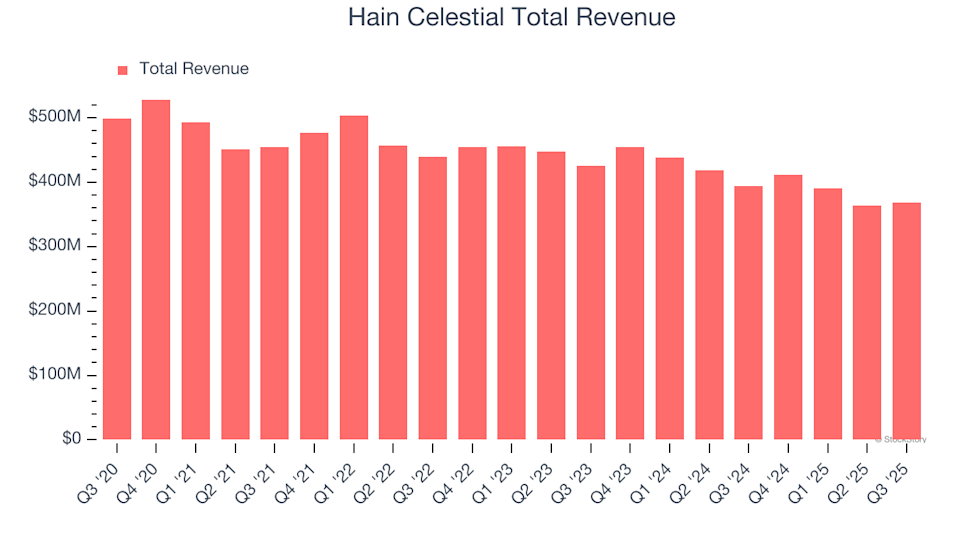

India has updated its regulations regarding deep tech startups