I’m Simply Anticipating This ETF’s Downfall. Here Are 5 Other Options Worth Exploring.

BIZD ETF: Navigating High Yields and Market Volatility

The VanEck BDC Income ETF (BIZD) is currently experiencing the classic dilemma of an investment that has attracted significant attention. When an ETF’s underlying theme becomes highly sought after, demand can surge beyond what the fund can realistically deliver, often leaving many investors disappointed.

Although BIZD boasts an impressive yield, it now faces challenges reminiscent of the recent downturn in the software-as-a-service (SaaS) sector. This shift, dubbed the "SaaS-pocalypse," emerged as artificial intelligence tools began to disrupt the enterprise software landscape—a sector where many business development companies (BDCs) have substantial loan exposure.

Related Market Updates from Barchart

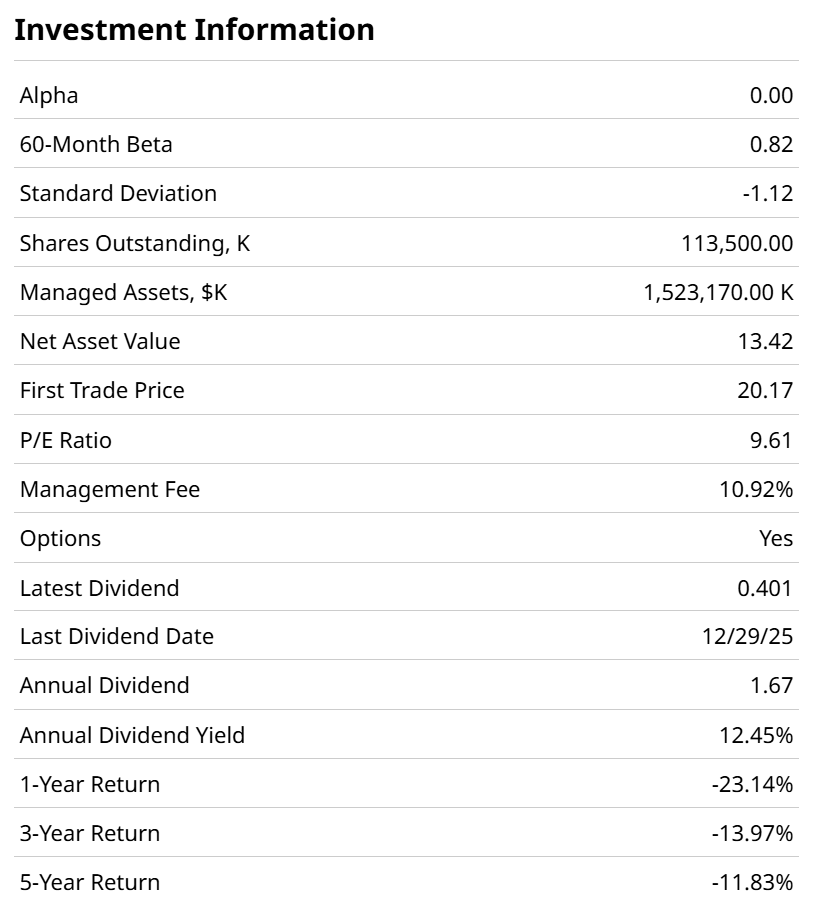

BIZD’s beta, currently at 0.82x, could rise sharply in the near future. As recent data shows, a 12% yield offers little comfort when the fund’s annualized price return has matched that figure in negative territory—and over the past year, losses have been even steeper.

While BIZD represents an appealing investment concept, its high yield comes with significant risks. Investors are often drawn to double-digit payouts, dismissing potential losses as long as monthly income remains steady. However, when prices drop, panic can quickly set in.

Another factor to consider is BIZD’s heavy concentration: just five holdings make up 82% of its assets. While concentrated portfolios can be attractive in certain environments, this level of exposure is particularly risky in today’s market.

Daily price charts reveal BIZD’s volatile swings, including a double top pattern and a return to previous lows, with little indication of an imminent recovery aside from the chance of a short-term rebound.

On a weekly basis, the outlook appears even more concerning. A declining 20-day moving average is worrisome, but a downward trend in the 20-week average signals deeper trouble ahead.

BIZD serves as a lender to mid-market private companies, giving investors access to private credit opportunities that are typically unavailable to the public. However, recent market turbulence—especially in early February—was fueled by concerns that private credit portfolios are overly exposed to mature software companies now facing competition from AI-driven solutions.

Is There a Path to Recovery?

BIZD’s largest positions will be crucial in determining its resilience during this period. Recent insider purchases at some of its core holdings may indicate management’s optimism, but the potential for lower interest rates later this year could force the fund to reduce its yield.

BDCs generally thrive in high-rate environments due to their floating-rate loans. However, if the Federal Reserve, possibly under Kevin Warsh’s leadership, implements significant rate cuts, BIZD’s attractive yields could quickly diminish.

For investors, BIZD presents a high-stakes scenario—an option for those willing to endure volatility and wait to see whether the software sector’s struggles will impact private credit, or if the fund can weather the storm.

Alternative Income Strategies

Given the current climate, a more conservative approach may be prudent. Instead of chasing high yields, consider reliable income sources such as Treasury ETFs: the BBG 1-3 Month T-Bill SPDR ETF (BIL), the iShares 0-3 Month Treasury Bond ETF (SGOV), or the iShares Short Treasury Bond ETF (SHV). There’s also growing potential for long-term rates to decline.

If market conditions worsen, long-duration bond ETFs like the iShares 20+ Year Treasury Bond ETF (TLT) and the iShares 10-20 Year Treasury Bond ETF (TLH) could benefit as 2026 approaches.

About the Author

Rob Isbitts developed the ROAR Score, leveraging over four decades of technical analysis expertise to help individual investors manage risk and build portfolios. For more of Rob’s research, visit .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

NANO Nuclear Reports Q1 FY 2026 Financial Results and Provides Business Update

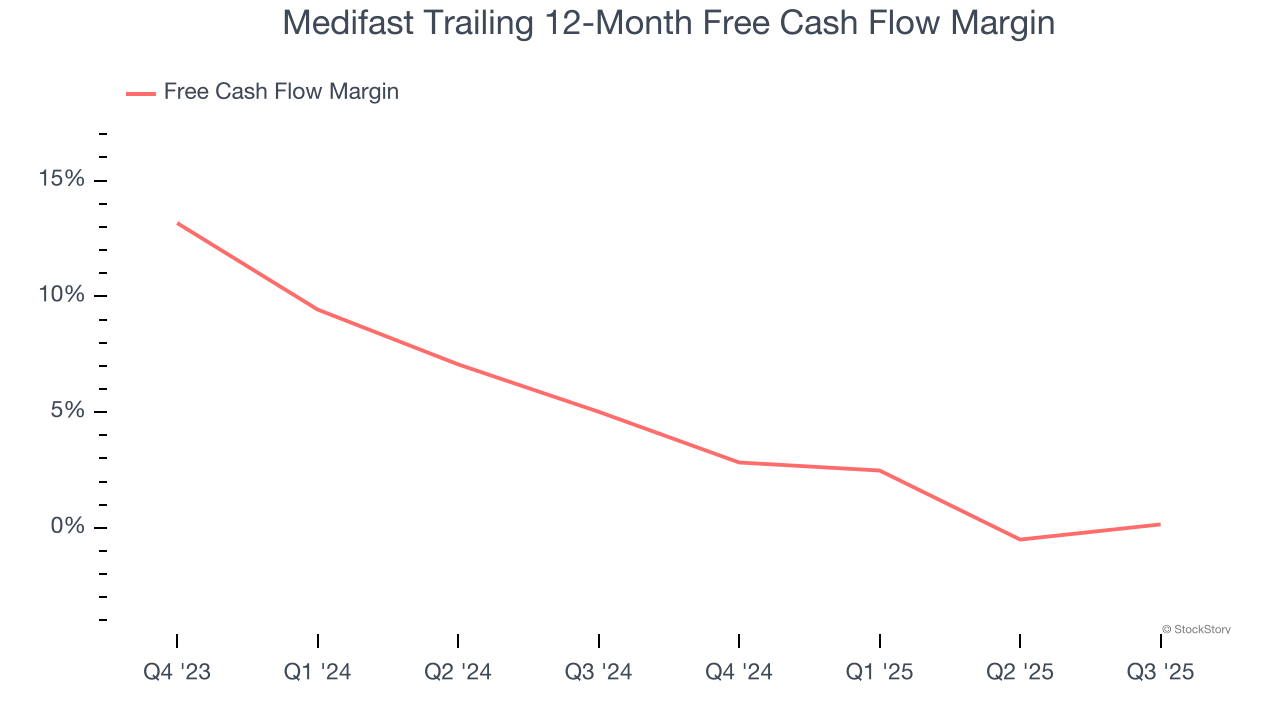

Medifast's (NYSE:MED) Q4 CY2025 Sales Top Estimates

SI-BONE To Present at TD Cowen 46th Annual Health Care Conference on March 2, 2026