News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Gold and Silver Rebound with Gold Back Above 5000; Nikkei 225 Hits New Historical High; US-India Reach Interim Trade Framework (February 9, 2026)2Why Alphabet's Free Cash Flow May Remain Resilient Even as the Market Worries - Strategies for Investing in GOOGL3Bitcoin Price Prediction 2026-2030: Unveiling the Critical Path for BTC’s Future Value

Dramatic Win for Takaichi, Beijing Issues Warning on US Bonds, and Starmer Continues to Face Challenges

101 finance·2026/02/09 12:27

Asian markets climb following Takaichi's victory in the election, as US futures move downward

101 finance·2026/02/09 12:27

Gold price update for Monday, February 9: Gold starts the day trading above $5,000

101 finance·2026/02/09 12:24

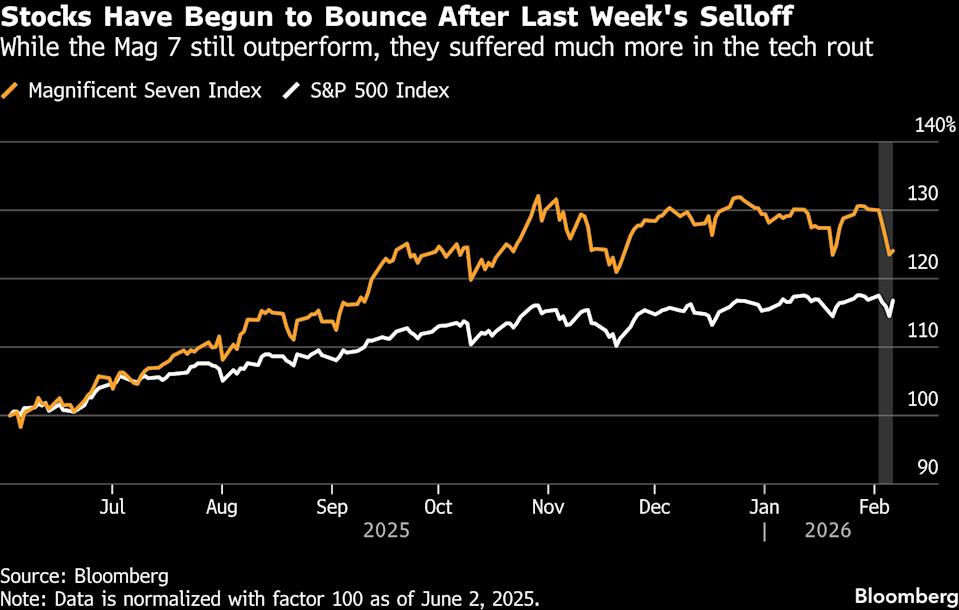

Morgan Stanley’s Wilson Believes AI Could Drive Tech Stocks Even Higher

101 finance·2026/02/09 12:03

Waters: Fourth Quarter Financial Results Overview

101 finance·2026/02/09 12:03

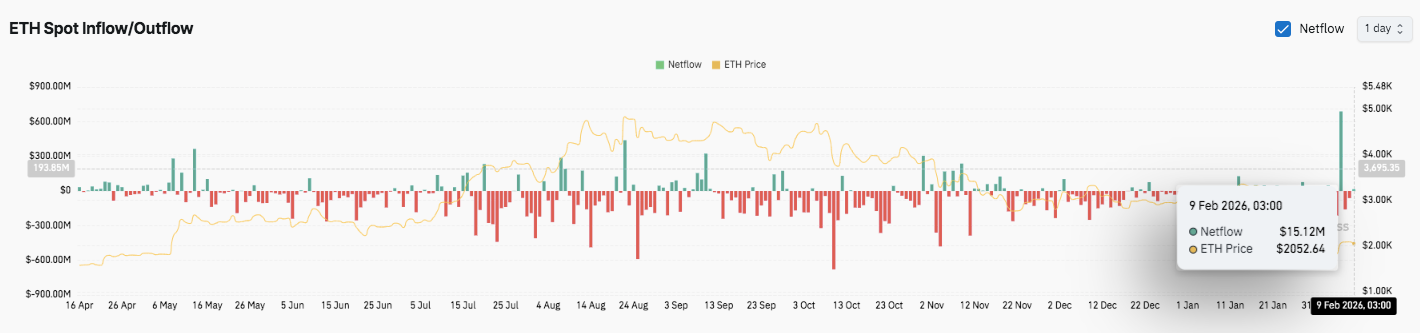

Ethereum Price Prediction: ETH Consolidates After Sell-Off, But Bears Still Control the Trend

CoinEdition·2026/02/09 12:03

Hyperliquid Stays Strong Following Ripple Partnership, Even as Market Optimism Fades

101 finance·2026/02/09 11:54

Curbline: Q4 Financial Results Overview

101 finance·2026/02/09 11:51

Dynatrace: Fiscal Third Quarter Earnings Overview

101 finance·2026/02/09 11:42

Ethereum Ecosystem Security Assessment Tool Developed

Coinspaidmedia·2026/02/09 11:42

Flash

12:23

Bloomberg macro strategist: The next potential major trading opportunity is U.S. Treasury bondsPANews, February 9 – Bloomberg macro strategist Mike McGlone analyzed that the next potential major trading opportunity is U.S. Treasury bonds. He stated: "The next potential major trading opportunity—if the pump-and-dump pattern of bitcoin, gold, and silver can serve as a reference—may be that by 2026, volatility in the stock and bond markets will have only one direction, which is a deflationary tendency. My analysis indicates that the prices of gold, silver, and copper may reach crypto-like peaks in 2025, which could make U.S. Treasury bonds the next major trading opportunity—especially if the stock market eventually returns to normal."

12:14

Analysis: Three Major Structural Factors Amplify the Current Bitcoin DowntrendAccording to Odaily, Bitcoin has recently experienced a sharp sell-off, retreating more than 50% from its historical high of approximately $126,200 in October 2025. Analysts believe that three major structural factors have amplified this round of decline: 1. Some opinions suggest that Asian capital may have triggered this round of sell-off by borrowing low-cost yen and establishing highly leveraged long positions in Bitcoin ETF-related options and crypto assets. When Bitcoin stopped rising and financing costs increased, this triggered margin calls and passive selling, exacerbating the market downturn; 2. Some banks may have been forced to sell assets due to risk hedging of Bitcoin structured products, creating a "negative Gamma" effect and amplifying the downward momentum; 3. Some mining companies are shifting to AI data center businesses while selling Bitcoin assets, leading to structural changes in the Bitcoin mining industry. (Cointelegraph)

12:10

Metalpha launches Bitcoin allocation plan, with up to 20% of annual net profit used to purchase BTCAccording to Odaily, Metalpha Technology Holding Limited, a Nasdaq-listed provider of blockchain and trading technology solutions, announced that its board of directors has approved a bitcoin purchase plan, allocating up to 20% of the company's annual net profit for bitcoin purchases. It is reported that the initial allocation of $3.2 million has been made, and a $1 million BTC purchase was completed on February 9.

News