News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin ETFs rebound with $166.5M inflows despite BTC price dip2Crypto Allocation in Asia: BlackRock’s Stunning $2 Trillion Prediction Reveals Institutional Shift3Solana Extends Losses Below $88 as Crypto Market Downturn Deepens

Crypto Phishing Scams Rise 72% In August To Steal Over $12 Million

Blockchain security firm Scam Sniffer attributed the 72% rise in crypto phishing losses to criminals exploiting Ethereum’s EIP-7702 upgrade.

BeInCrypto·2025/09/06 09:14

The Nasdaq’s historic market cap surge is unprecedented and ‘insane’

CryptoSlate·2025/09/06 09:00

SOL Strategies Secures Nasdaq Listing, Set to Trade as STKE

Cryptotale·2025/09/06 08:45

TRON Leads Blockchain Fees in 30 Days, Surpassing Ethereum by 28%

TheCryptoUpdates·2025/09/06 08:35

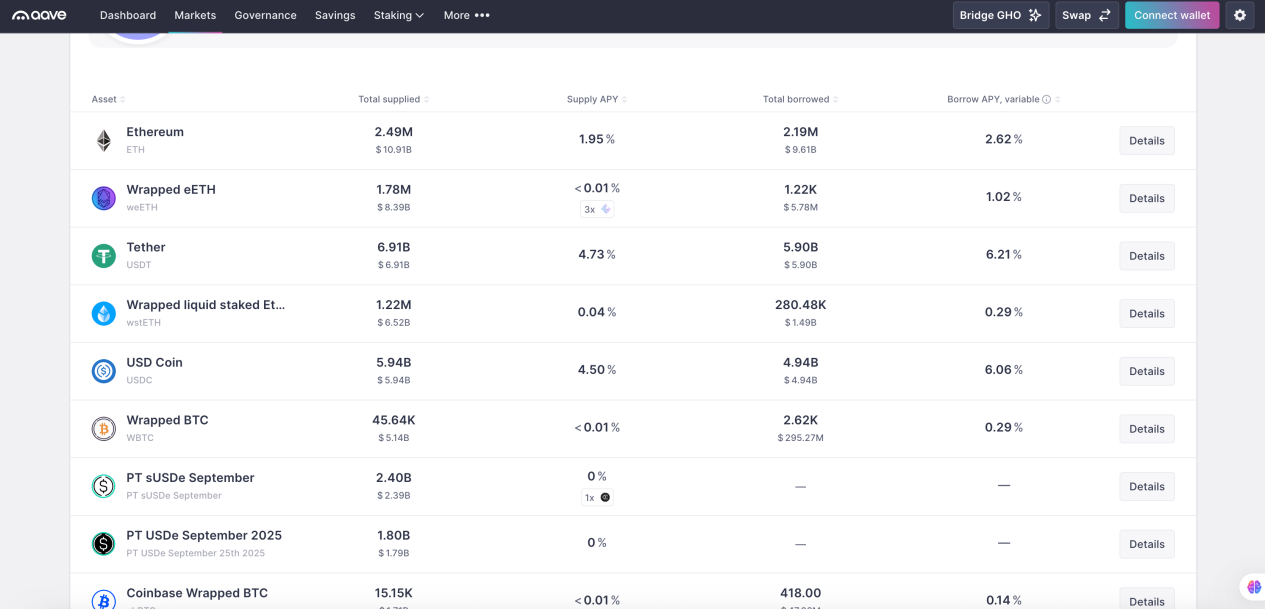

DeFi Beginner’s Guide (Part 1): How AAVE Whales Use $10 Million to Arbitrage Interest Rate Spreads and Achieve 100% APR

A quick introduction to DeFi, analyzing the returns and risks of different strategies based on real trading data from DeFi whales.

深潮·2025/09/06 08:34

Belarus Aims for Global Crypto Hub with New Regulatory Framework

Cryptotale·2025/09/06 08:05

Hyperliquid (HYPE) Price Set To See a New All-Time High Amid Sustained Rally

Hyperliquid is trading just below its peak, with bullish indicators and strong RSI positioning HYPE for a possible new all-time high soon

BeInCrypto·2025/09/06 07:16

Why was Michael Saylor’s Strategy snubbed by a S&P 500 secret committee?

CryptoSlate·2025/09/06 07:00

Rate Cuts Could Spur Bitcoin Gains as Analysts Forecast Multiple Fed Cuts in 2025

Coinotag·2025/09/06 05:35

Flash

02:18

CICC Wealth today released a fundamental analysis of precious metals, noting that almost all major global institutions are overwhelmingly bullish on gold.The reasons are also quite consistent, namely the normalization of geopolitical conflict risks, the ongoing global de-dollarization of assets, central bank gold purchases, geopolitical risks, and the shift of the gold pricing anchor from a real interest rate-dominated framework to a credit risk hedging framework. From an allocation perspective, a simple estimate suggests that by 2026-2028, the proportion of investable gold may exceed the 2011 peak (3.6%), and gold prices are expected to rise to $5,100-6,000 per ounce. As for silver, we believe that after the gold-silver ratio is corrected, the range will be between 55-80. If silver is overbought, it will still face policy suppression and short squeeze risks, so silver will mainly follow the trend of gold.

02:11

Polygon: Plans to reclaim $1 million in base gas fees to optimize inter-agent transactionsAccording to Odaily, Polygon posted on X stating that for agentic commerce at scale (where AI agents autonomously complete commercial transactions and payments), friction must be eliminated, and payments need to be instant and have nearly zero, predictable fees. The PIP-82 proposal suggests that up to $1 million in base gas fees be reclaimed by Polygon x402 facilitators to accelerate transactions between agents and further reduce the cost for AI agents. It is reported that Polygon holds a significant share in Agentic Commerce and has processed several key AI agent transactions. For example, OpenClaw completed the first fully autonomous AI-to-AI commercial transaction on Polygon (including automatic listing, pricing, negotiation, deal closing, and payment collection).

02:10

Bare holding Ethereum underperforms US cash, ETH may face a "lost decade"BlockBeats News, February 13, according to market information from a certain exchange, Ethereum briefly entered the $1,800 range this morning and may face a "lost decade" in the future due to returns falling below cash interest rates. As early as January 2018, the price of Ethereum reached above $1,400. Adjusted for US CPI inflation and compound interest, $1,400 in 2018 would be equivalent to about $1,806 in February 2026. If investors hold Ethereum without staking for eight years, they may underperform US dollar cash.

News

![[Bitpush Daily News Selection] Trump Media completes acquisition of 684 million CRO tokens worth about $178 million; Ethena Foundation launches new $310 million buyback plan; Vitalik Buterin: Low-cost stablecoin transactions remain one of the core values of cryptocurrency; Spot gold rises to $3,600, hitting a new all-time high](https://img.bgstatic.com/multiLang/image/social/28ccebdba840f2fa20c951ded37503be1757072702741.png)