News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 17)|Fed may announce 25 basis point rate cut at FOMC meeting; ZKsync to unlock 173 million tokens today; US and UK to deepen cooperation on crypto regulation2Bitcoin May Consolidate Around $115,000–$116,000 as Market Attempts to Stay Bullish, CoinStats Says3Cardano Shows Mixed Signals as Short-Term Charts Trend Bearish While Cycle Analysis Suggests Possible Early Bullish Phase

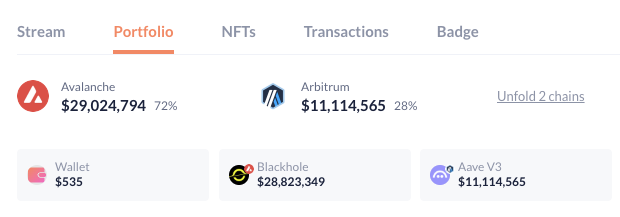

Hyperliquid Vault Manager Under Fire for Moving $29 Million of User Funds to Other Blockchains

CryptoNewsNet·2025/08/08 00:10

Trump Signs Executive Order Prohibiting Debanking of Crypto Industry

CryptoNewsNet·2025/08/08 00:10

Bitcoin Short-Term Holders Are Capitulating—Will June Pattern Repeat?

CryptoNewsNet·2025/08/08 00:10

Fundamental Global Files $5B Shelf Registration Opening Door to Major ETH Purchases

CryptoNewsNet·2025/08/08 00:10

Ethereum Crosses 0.03200 BTC Mark While All EMAs Offer Strong Support

CryptoNewsNet·2025/08/08 00:10

U.S. Stock Indices: Crucial Mixed Signals for Crypto Investors

BitcoinWorld·2025/08/08 00:05

Trump Crypto Orders Unlocks New Era for Digital Asset Access

BitcoinWorld·2025/08/08 00:05

Fundamental Global ETH: Massive $5 Billion Investment Plans Unveiled

BitcoinWorld·2025/08/08 00:05

Core Scientific Buyout: Crucial Shareholder Opposition Rocks $9 Billion CoreWeave Deal

BitcoinWorld·2025/08/08 00:05

SEC-Ripple Litigation: A Monumental Victory for Crypto Clarity

BitcoinWorld·2025/08/08 00:05

Flash

- 16:05Data: Bitcoin records the second largest single-day inflow in 2025, with 29,685 BTC flowing into accumulation addresses today.BlockBeats News, September 17, according to data released by CryptoQuant, long-term bitcoin holders are significantly increasing their holdings. Today recorded the second largest single-day inflow in 2025, with a total of 29,685 BTC flowing into bitcoin accumulation addresses through over-the-counter transactions, valued at approximately $3.4 billion.

- 16:04BlackRock Adjusts $185 Billion Investment Portfolio, Betting on U.S. Stock Market Performance and AI TrendsBlockBeats News, September 17 — An investment outlook report shows that the world’s largest asset management company, BlackRock, is “raising its risk allocation”—significantly increasing its holdings of U.S. stocks and expanding its exposure to the artificial intelligence (AI) sector within its $185 billions model portfolio platform. The outlook report points out that, thanks to the “top-tier earnings performance” of the U.S. stock market, BlackRock has increased its allocation to U.S. equities in its series of model portfolios at the expense of reducing holdings in international developed market stocks. After the adjustment, the overall stock holdings in these portfolios are overweighted by 2%. Data shows that on Tuesday, as BlackRock completed its asset allocation adjustment, its corresponding ETFs saw capital flows in the billions of dollars. This adjustment to the model portfolios is seen as a “vote of confidence” in the U.S. stock market rally: since the beginning of this year, driven by the investment boom in the AI sector and market bets on an imminent rate-cutting cycle by the Federal Reserve, the S&P 500 Index has reached record highs. BlackRock stated in its investment report that the relatively strong earnings performance of U.S. companies will continue to drive U.S. stocks higher, noting that since the third quarter of 2024, U.S. corporate earnings have grown by 11%, while earnings growth for similar companies in other developed markets has been less than 2%. (Golden Ten Data)

- 16:04SEC Cryptocurrency Special Task Force to Organize a Series of Public MeetingsBlockBeats news, on September 17, the U.S. Securities and Exchange Commission (SEC) officially announced that the Crypto Assets and Cyber Unit is actively preparing to arrange opportunities for stakeholders to meet with crypto-friendly Commissioner Hester Peirce and her team. In order to promote open dialogue and transparency, the SEC will publish the agenda and the list of representatives participating in each meeting.