News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Share link:In this post: Bailey publicly backed Powell, calling him a friend and criticizing Trump’s ongoing attacks. The Bank of England cut rates by 25bps after a split vote, pushing the pound up and the FTSE 100 down. Trump is actively looking to replace Powell, with Waller, Hassett, and Warsh in consideration.

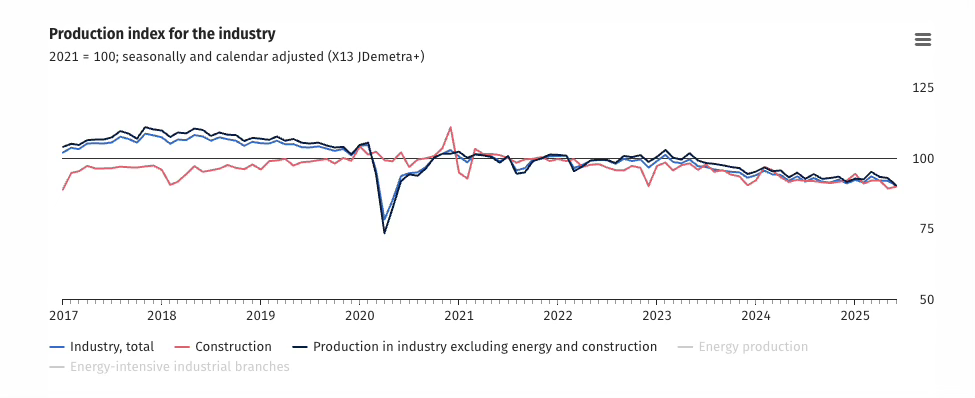

Share link:In this post: • Germany’s industrial output falls to pandemic lows. • Berlin’s foreign trade surplus drops below €15 billion in June. • German exports rise largely due to shipments to other EU nations.

Share link:In this post: Sony has raised its annual profit forecast by 4% to ¥1.33T ($9B) due to less than anticipated impact from U.S. tariffs. Q1 operating profit rose 36.5% year-on-year to ¥340B ($2.3B), beating analyst estimates. Sony is preparing a partial spin-off of its financial business, reducing its stake to below 20% with a Tokyo listing planned for September 29 of this year.

Share link:In this post: Chainlink has launched a LINK reserve funded by real on-chain and off-chain revenue. The reserve uses Payment Abstraction to convert various fees into LINK tokens. LINK’s price jumped 6.8% after the announcement, signaling market confidence.

Share link:In this post: GM will import Chinese EV batteries from CATL for its new Chevrolet Bolt, despite 80% tariffs. The decision comes after the elimination of the $7,500 EV tax credit, which would have disqualified the Bolt due to its Chinese components. LFP batteries are about 35% cheaper than other alternatives.

With nearly $5 billion in Bitcoin and Ethereum options expiring, traders are watching BTC’s EMA 100 and 112K strike for potential volatility.

Ethena price is rising fast as whale accumulation, bullish crossovers, and OBV divergence support the case for a major breakout ahead.

- 18:29Federal Reserve Dot Plot: Overall More Dovish, One Official Expects 150 Basis Points Rate Cut This YearChainCatcher news, according to Golden Ten Data, the Federal Reserve dot plot shows that among 19 officials, 1 official believes there will be no rate cuts in 2025, 6 officials believe there should be a cumulative rate cut of 25 basis points, 2 officials believe there should be a cumulative rate cut of 50 basis points, and 9 officials believe there should be a cumulative rate cut of 75 basis points. Most likely, one official from Milan expects a significant rate cut of 150 basis points in 2025 and believes there will be at least two more significant rate cuts within the year.

- 18:29Federal Reserve economic projections indicate downside risks to real GDPAccording to Golden Ten Data, ChainCatcher reported that the charts in the Federal Reserve's economic outlook show that most participants believe the uncertainty facing actual GDP is higher, with risk expectations skewed to the downside.

- 18:17The probability of a Fed rate cut in October is risingAccording to Jinse Finance, after the FOMC statement, U.S. interest rate futures expect a 94% probability that the Federal Reserve will cut rates in October, compared to 71.6% before the statement.