News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

HPX Partners with EmoFi to Tokenize User Information OnChain

BlockchainReporter·2026/03/09 13:10

Elon Musk Mocks Jim Cramer's 2010 Tesla Predictions: 'Inverse Cramer Is Incredible'

Finviz·2026/03/09 13:09

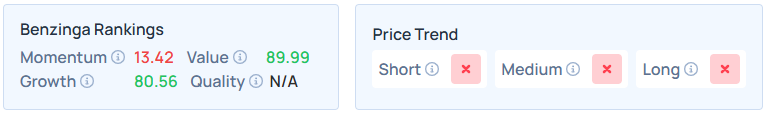

Amazon Rival PDD Value Score Inches Higher Despite Texas Tech Ban And Over 10% YTD Decline

Finviz·2026/03/09 13:09

Coherent to Join the S&P 500

Finviz·2026/03/09 13:09

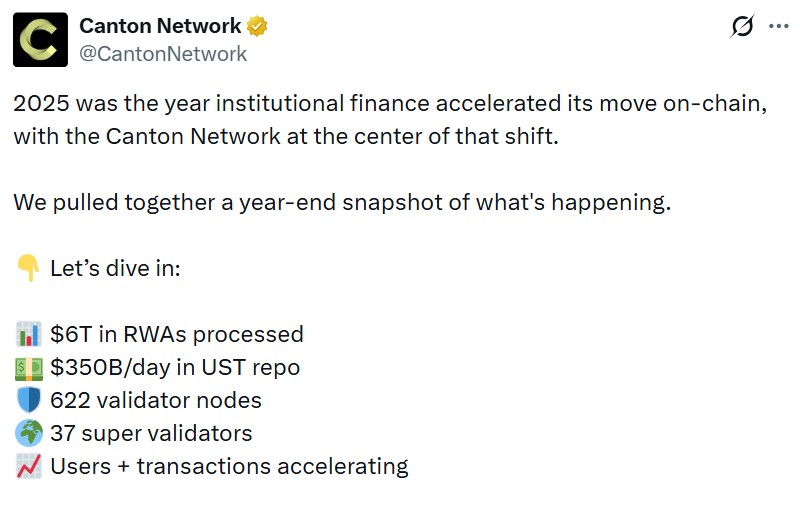

Banks will run RWAs on two blockchain rails, says RedStone co-founder

Cointelegraph·2026/03/09 13:09

Nigel Farage takes £215k stake in Kwasi Kwarteng’s Bitcoin business

101 finance·2026/03/09 13:06

Flash

17:50

Renowned investor Ahmet Okumus recently increased his holdings in Domo Inc., basing his investment decision on a clear judgment: at the time of purchase, the company's stock price was significantly below its intrinsic value, indicating an "undervalued" status.This move highlights its strong confidence in Domo Inc.'s future growth potential.

17:28

European military industry stocks fluctuateLeonardo, listed in Milan, Italy, closed up 6.58% at 62.48 euros, surpassing the previous all-time closing high of 60.40 euros set on March 4, after Barclays upgraded its rating on the company. WisdomTree Europe Defence UCITS ETF (EUDF.GY), listed in Germany, closed up 1.90% at 34.400002 euros. The Future of Defence UCITS ETF (NATO.LN), listed in London and known for its comprehensive exposure to defense stocks, closed up 0.80%.

17:21

MakerDAO founder gave up all his profits from long positions in crude oil and added another $2 million to his position. according to lookonchain monitoring, affected by the decline in oil prices, MakerDAO founder Rune Christensen has fully lost the seven-figure profits previously gained from going long on crude oil, but he has not closed the position. He chose to increase his position, placing a limit buy order worth 2 million USD, which is currently being executed.

Trending news

MoreRenowned investor Ahmet Okumus recently increased his holdings in Domo Inc., basing his investment decision on a clear judgment: at the time of purchase, the company's stock price was significantly below its intrinsic value, indicating an "undervalued" status.

3 Reasons Growth Investors Will Love Markel Group (MKL)