News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin adoption ‘booming’ while price chops: Which metrics matter most?2SEC approval sought for JitoSOL Solana-based liquid staking token ETF3Crypto Biz: A Bitcoin treasury shareholder revolt

Trump’s Pledge on Affordability Compared to Actual Costs

101 finance·2026/02/27 22:25

Amazon's $50B OpenAI Strategic Alliance Drives $11.86B Trade Volume Ranks 7th in Market Activity

101 finance·2026/02/27 22:21

Apple's Fourth-Highest Trading Volume Amid Record Earnings Fails to Lift Stock as Shares Fall 3.2%

101 finance·2026/02/27 22:18

Cardano deploys USDCx as stablecoin liquidity grows despite falling TVL

AMBCrypto·2026/02/27 22:15

Cloud Mining Process Evaluation: Assessing Platform Sustainability in 2026 from a Financial Flow Perspective

101 finance·2026/02/27 22:09

Oneok (OKE) Announces Fourth Quarter Earnings: Insights from Major Performance Indicators

101 finance·2026/02/27 22:04

Volvo Trucks begins serial production of redesigned VNR at Virginia plant

101 finance·2026/02/27 22:03

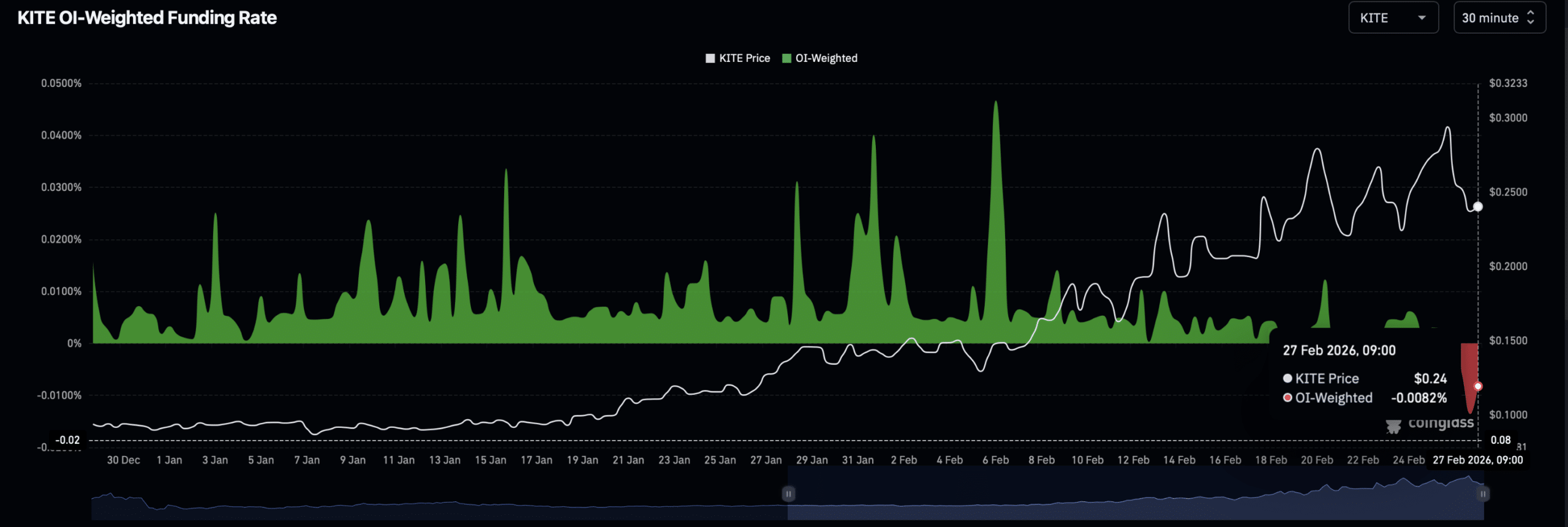

How KITE’s pullback tests bullish resolve after 74% February rally

AMBCrypto·2026/02/27 22:03

Paramount must convince regulators its deal with Warner will not hurt customers

101 finance·2026/02/27 21:54

Flash

12:37

CertiK: February Security Incident Totaled Roughly $35.7 Million, the Lowest Since March 2025BlockBeats News, February 28th, according to CertiK Monitoring, the total loss from all security incidents in February was approximately $35.7 million, with around $8.5 million attributed to phishing attacks. This is the lowest monthly loss since March 2025.

12:26

Bubblemaps: Six suspected insiders profited $1.2 million by betting on "U.S. launching an attack on Iran"Foresight News reported, according to monitoring by Bubblemaps, six suspected insiders profited $1.2 million by betting on the event "the United States launches an attack on Iran." These wallets received funds within the past 24 hours and specifically placed bets on February 28, purchasing "Yes" a few hours before the attack (UTC+8).

12:22

Israeli Ministry of Energy: Ordered temporary closure of some natural gas reserves in IsraelThe minister is expected to announce that the natural gas industry will enter a state of emergency. If necessary, the country's energy demand will be met through alternative energy and alternative fuels.

News