News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Spot Gold & Silver Continue to Drop, Bitcoin Crashes; Amazon’s $200 B Capital Expenditure Raises Concerns; U.S. Job Openings Fall to 2020 Lows — Feb 6, 2026 (English Translation)2Weekend Trading Playbook: High-Impact Macro Events & Earnings for Feb 9-15, 2026 – Tech & Crypto Volatility Plays3 Is the “Perfect Storm” Here? Liquidations Explode as Bitcoin Bleeds Below $70K & DXY Rises

Explainer – Why is Bitcoin under so much sell pressure right now?

AMBCrypto·2026/02/08 06:03

Curve DAO Token (CRV) Price Prediction 2026, 2027-2030: Can CRV Break Its Long-Term Range?

Coinpedia·2026/02/08 03:30

20% Bounce and an ETF Filing: Why ONDO Price is Separating from the Crypto Pack.

Coinpedia·2026/02/08 03:30

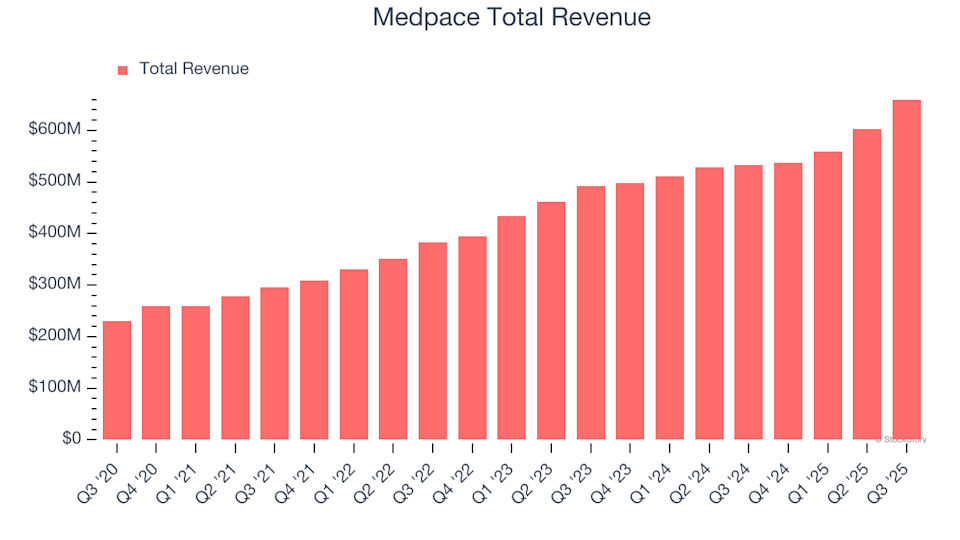

Earnings To Watch: Medpace (MEDP) Will Announce Q4 Results Tomorrow

101 finance·2026/02/08 03:12

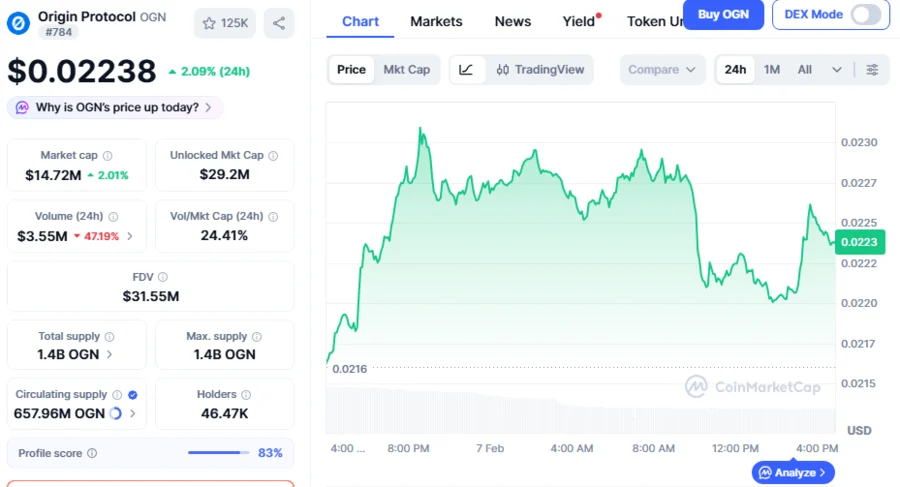

OGN Trades At $0.02229 Crucial Support, Sets Up for Further Bear Market: Analyst

BlockchainReporter·2026/02/08 03:00

Hims drops intention to offer compounded GLP-1 capsules following FDA criticism

101 finance·2026/02/08 01:24

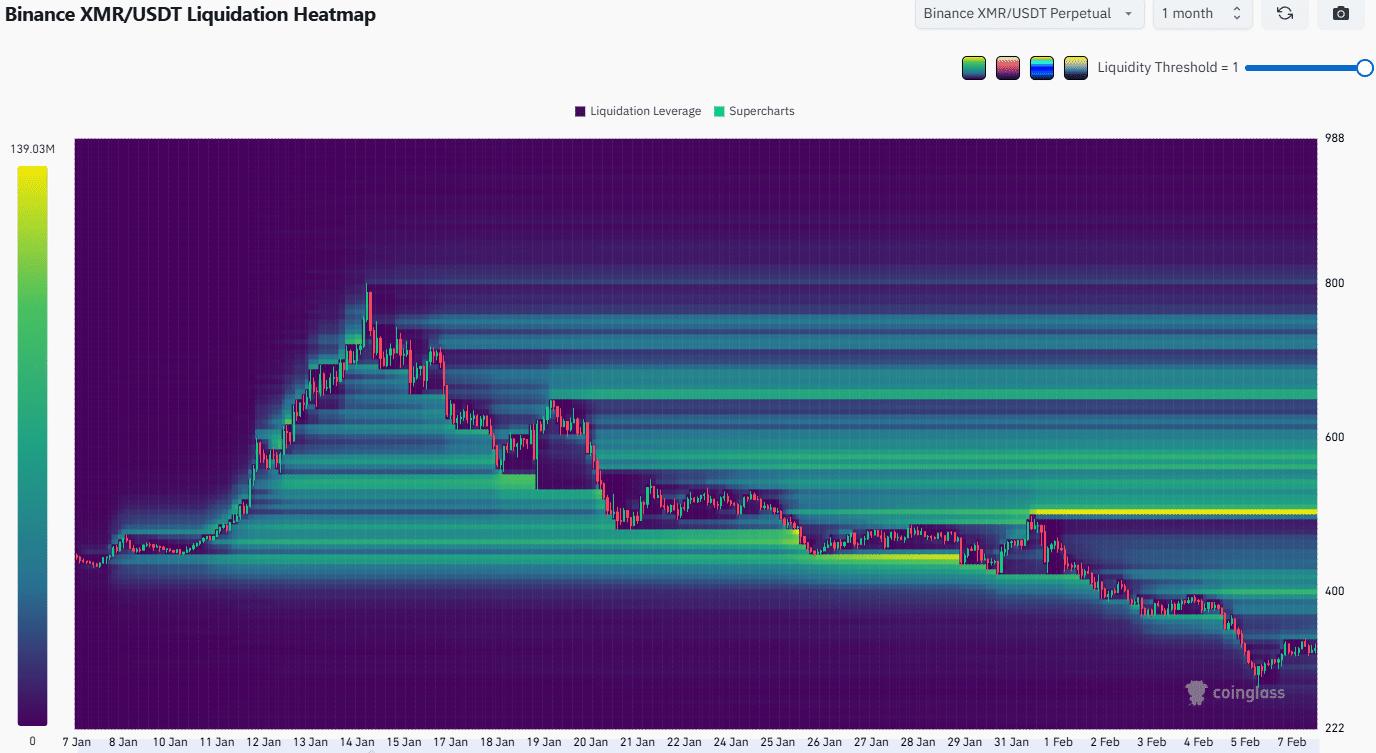

Monero falls from FOMO to 63% freefall – What’s next for XMR?

AMBCrypto·2026/02/08 01:03

Flash

06:11

Next week’s White House crypto meeting will focus on stablecoin yields, with bank representatives attending for the first time.BlockBeats News, February 8, crypto journalist Eleanor Terrett disclosed details of next Tuesday's White House crypto meeting. This meeting is the second round in a series of meetings, still at the staff level, and will not invite CEOs of companies to attend, but senior policy personnel from various banks will be present. According to sources, several major banks, including Bank of America, JPMorgan, and Wells Fargo, have already received invitations, and PNC Bank, Citibank, and U.S. Bank may also be included. Banking industry representatives include the Bank Policy Institute, the American Bankers Association, and the Independent Community Bankers of America, but it is expected that the number of representatives from each party will be reduced. The current situation is that banks want to restrict crypto companies from offering stablecoin interest, believing this threatens their own business. They are concerned that a large influx of funds into high-yield crypto accounts could lead to a shortage of bank lending funds and trigger broader financial turmoil. Crypto companies, on the other hand, believe that banks are trying to undermine market competition, maintain their own regulatory barriers, and hinder innovation. On Thursday, Treasury Secretary Scott Besant appeared to acknowledge that the banks' concerns have some merit, stating this Thursday: "I have always been an advocate for these small banks, and deposit volatility is highly undesirable. We will continue to work to ensure that stablecoin yield payments do not lead to deposit volatility." This meeting concerns the future of the "Cryptocurrency Market Structure Bill" (CLARITY Act). Currently, the issue of stablecoin yields has become the focus of attention at the White House, its importance even surpassing other controversial points such as ethics or decentralized finance. Patrick Witt, Executive Director of the White House Cryptocurrency Committee, urged all parties to reach an agreement by the end of this month.

05:51

Bullish CEO: The crypto industry is set for large-scale consolidationPANews, February 8th – According to Cointelegraph, Bullish CEO Tom Farley stated in an interview with CNBC that the cryptocurrency industry may see a trend of more projects being acquired by large companies, which could further unify the industry landscape in the coming months. Farley believes that industry consolidation should have occurred a year or two ago, but excessively high valuations sustained a false sense of optimism. Many companies will realize that "they have no business, only products."

05:17

Bitwise CIO: The next bull market will be driven by nine core narratives, including AiFi, revenue-generating products, and Vitalik's return to EthereumAccording to Odaily, Bitwise Chief Investment Officer Matt Hougan stated on the X platform that cryptocurrency is driven by narratives, and currently there are nine major narratives expected to lead the next cycle. First, revenue-generating products. Blockchain annual revenue is currently about $7 to $8 billions. As mainstream adoption accelerates, industry revenue will scale to hundreds of billions of dollars, and projects that generate revenue will be rewarded. Second, AiFi. AI agents will use cryptocurrency, stablecoins, and DeFi instead of bank accounts, and its scale is difficult to estimate. Third, the decline of fiat currencies. As fiat currencies depreciate, the world will turn to hard currencies, including BTC. Fourth, institutional adoption. Institutional adoption of cryptocurrency is a decade-long major trend, and its scale will be measured in trillions. Fifth, regulatory progress. The benefits of proactive regulation have yet to be realized. The Genius Act will take effect in January 2027. After regulatory clarity, investment and mainstream adoption will see hockey stick growth. Sixth, the stablecoin supercycle. Although stablecoin assets under management have temporarily stagnated at $300 billions, in the future they will grow to several trillions, becoming the backbone of global payment rails in the 21st century. Seventh, tokenization. Currently, only $20 billions in assets have been tokenized, while the total value of global stocks, bonds, and real estate markets reaches hundreds of trillions, with a market penetration rate of less than 0.1%. Eighth, DeFi revival. With the tokenization of RWA assets and improved protocol tokenomics after regulatory clarity, the scale of DeFi will expand by 100 times. Ninth, Ethereum's "Steve Jobs returns moment." Vitalik Buterin's return to the Ethereum ecosystem is likened to Steve Jobs' return to Apple in 1996, and Ethereum's development is set to enter a period of explosive growth.

News